UK Tax Strategy

The First Abu Dhabi Bank P.J.S.C. (“Group” or “Bank”) including its London branch publishes its Group Tax Strategy in accordance with paragraph 22(2), Schedule 19 of Finance Act 2016. The Strategy is applicable for the year ending 31 December 2026. Our Strategy embodies the Group’s Banking business model, and aligns taxation decisions, in each of the jurisdictions it operates in, ensuring [tax] compliance with best practices.

The Group is headquartered in the United Arab Emirates (“UAE”), and in particular, in the Emirate of Abu Dhabi. The Group is seen as the largest Bank in the region on several metrics and carries out its responsibilities accordingly. The Group is subject to Federal Corporate Income tax in the UAE for the full year 2024, including Tax Transfer Pricing regulations largely following the OECD Guidelines for Multinational Enterprises and Tax Administration 2022.

Further, effective 1 January 2025, the Group is subject to the OECD BEPS Pillar 2 (“Minimum Tax”), as announced by the UAE on 8 February 2025 following the publication of Federal Decree Law No. 60 of 2023, amending certain provisions of the Law in Cabinet decision No. 142 of 2024.

The Group is actively assessing the impact of the Minimum Tax and engaging external advisors to ensure accuracy in calculating and reporting of the effective tax rate across all jurisdictions, in accordance with Pillar 2 requirements.

Regular reviews are conducted to monitor developments in local legislation and guidance, and the Group is committed to maintaining transparency and compliance with all relevant Pillar 2 obligations. The Group Tax function is working closely with local Finance teams and external advisors to ensure resolution of any operational challenges that may arise.

In the UK, the Bank has adopted HMRC’s Code of Practice for the Taxation of Banks and continues to be supportive of global initiatives to improve tax transparency, ESG accountability, and compliance. The Bank publishes an annual Environmental, Social and Governance [“ESG”] report compliant with Global Reporting Initiative (GRI) Standards 2021, and Sustainability Accounting Standards Board (SASB) ‘Industry Standards’, as well as being AA (“Leader”) rated by the MSCI ESG index in 2025.

Governance

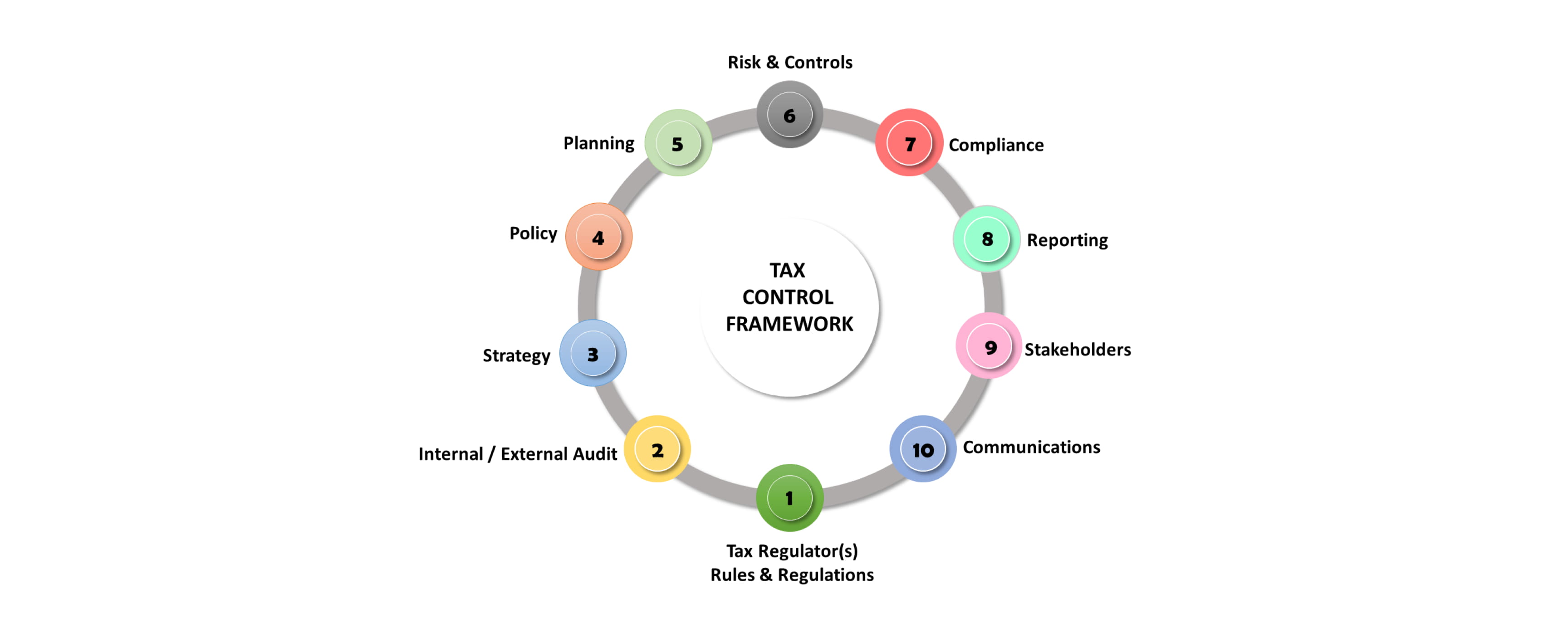

The Group has an established Tax Control Framework (“Framework”) to which it adheres to. For ease of reference, the Framework is set out in the Appendix to the Strategy document. Leading from the Framework are governing principles and policies embedded within the wider Group organisation.

The London branch is aligned on its Senior Accounting Officer (“SAO”) responsibilities and obligations thereunder. While the Group has a Tax function comprising of adequately qualified staff to manage the tax affairs of such a Group, it leverages the wider Finance function in each geographical location in which it operates with sufficient support from local external professional advisors to manage its tax affairs. All tax compliance and reporting requirements are the responsibility of local Finance functions, and any policy or governance issues, to the extent not localised, are responsibility of the Group tax function.

Planning

All business transactions, products, client relationships, and counterparties are purely driven by commercial and business needs. Accordingly, any tax outcome is consequential. Tax review and / or due diligence on business transactions and commercial matters are conducted to identify documentation requirements, tax indemnities and warranties provided (or required) by the Group, and where a choice of [tax] outcome is available, to opine on the most suitable outcome in relation to the proposal. The wider Tax control framework incorporates the necessary attention required. Where transactions require external advice, due to a customer in a different jurisdiction, or, a complexity nature of a transaction, external advice is sought to protect the Bank’s tax position.

The Bank in the normal course of its business does not provide any tax advice or direction to its clients, counterparties, or to third party agents. Accordingly, any tax planning undertaken by the Group whether on its own corporate affairs, financial and economic products, or other transactions, is limited to choosing only an optimal outcome where a choice of outcomes are available.

Generally, planning undertaken by Group tax is commensurate with scheduling or forecasting rather than schemes. Given this, the Group considers itself to be fairly benign on a risk of challenge for tax planning.

Risk

The Group’s intention is to pay its fair share of taxation in all the jurisdictions it operates in, reflecting its presence and substance, and is mindful of its commitments to the wider environment including its obligation as an active corporate citizen.

The Group manages its tax risk within the wider Risk Framework and policies of the Group; it has no appetite for unnecessary tax risks, either planned or consequential. All tax risks are captured within the Group’s operating model, and each business manages its own tax risk matrix with proper engagement with Group Tax, Local Finance, and including use of professional tax advisors as necessary.

The Group operates a 3 Lines of Defence [3-LoD] Risk model with the Group Tax function residing within the wider Group Finance function, which is a direct support function and Control part of the model. Commensurate not only with the complexity of each Business division but also each jurisdiction in which the Group operates, appropriate nexus among Business management, Finance function, Tax function, and external [local] advisors are held at periodic times and as needed. In addition, application of regulatory differences between the Financial and Taxation Regulators may need to be considered and accordingly business management appraised with input from Group [Regulatory] Compliance function. Further, the self-assessment nature of the UK Regulatory environment is noted and where specific requirements are identified, monitoring and controls are incorporated as approved by local Senior management with assistance from external advisors as well as input from Group Tax.

The Group Internal audit function as a 3rd line of Defence in the Risk model performs its duties in ensuring tax risks are mitigated on a best efforts basis. Any issues arising are attributed to the correct function and addressed within a reasonable timeframe.

Dealing with HMRC

The Branch is committed to an open and transparent dialogue with its tax authority. No formal meetings are held or required to be held with the Tax authority. Any tax concerns or issues are initially discussed between the Branch and its tax advisors and based on advice received the Branch would make the appropriate amendments to its reporting and /or engage with HMRC as appropriate.

Within the UK the key persons responsible for contact with HMRC are primarily the UK CFO supported by local professional tax advisors, Senior Management, and ultimately the Group Head of Taxation.