Our latest analysis on the recent developments in Venezuela.

Our global markets team analysis on the big stories of the moment across the region.

Key Risks in 2026

The invention of the printing press by Johannes Gutenberg in the 15th century had a dramatic effect on the world by sharply raising levels of literacy and the spread of knowledge. The consequent faster distribution of information encouraged new ideas in the areas of science, religion, politics, and philosophy, which in turn helped to generate the ‘Renaissance’ and the ‘Age of Enlightenment’ with the latter period eventually culminating in the French Revolution. Today, most researchers agree that Artificial Intelligence will have an even bigger positive and negative impact on society than the printing press, especially as this is the first technology that is able to teach itself. In this piece we highlight again some of the risks that AI poses in our increasingly more polarized and uncertain world, as well as a number of other important issues to keep an eye on in 2026 and beyond.

Oil Market Review 2025/26

In this research piece, we outline the range of factors impacting the oil market’s performance this past year and discuss what 2026 may bring.

SITREP Iran

Our initial thoughts on Israel’s unilateral attack on Iran on 13th June morning.

Oil Market Update – Q1 2025

Various factors have been behind the sharp sell-off in crude prices over the past two months, including the impact US trade tariffs may have on global economic growth. In this note, we discuss these key drivers well as some potentially more supportive factors such as rising geopolitical risks.

The Oil Market – 2024/25

This past year has been another rather mixed one for crude prices, with geopolitical risks and OPEC+ cuts providing support, whilst ongoing uncertainty on the outlook for global demand especially with China’s economic recovery continuing to look tepid at best, combined with a strong US dollar has kept the upside limited too. In this piece we briefly summarize the current state of the oil market and what may lie ahead in 2025 and beyond.

Key Risks In 2025

As 2024 draws to a close, the impact of the past 12 months from conflicts to hotly contested elections will no doubt continue to be felt in the year ahead. In this piece we focus on a few of the key risks to keep an eye on in 2025, some of which are not that new but are becoming far more acute in our polarized world.

US Election 2024

By the end of this year more than 65 countries will have held national elections, including several of the world’s largest democracies such as India, Indonesia, UK and the US. But it’s the latter poll that contains the greatest element of risk from both a political and economic standpoint. In this short piece we explain why that is and what could be the most likely outcome.

House View on Oil – June 2024

Oil prices had a mixed performance during the first half of this year, as traders attempted to digest various factors including geopolitical risks, OPEC+ actions, US output, a strong US dollar and demand uncertainty. In this note we analyze the current state of the crude market and its near-term outlook.

Key Risks In 2023

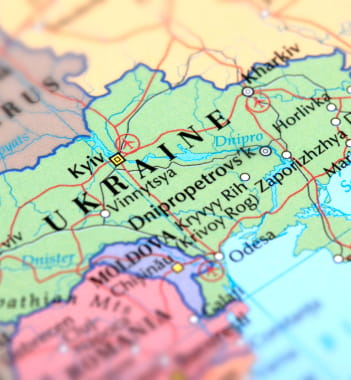

In our previous ‘Key Risks’ outlook, which was published back in January this year, we listed food prices as one of the major issues to watch in 2022, as well as cybersecurity, Ukraine and US/China relations. All four remain a major concern and thus make a return in our ‘watch’ list for 2023 attached, albeit from a more nuanced standpoint.

US Midterm Elections 2022: 'It’s the economy stupid’

The US midterm elections are now less than one week away and although they do not involve the Presidency directly, they will have an effect on the direction of the country as well as influencing the playing field for the 2024 general election. Historically the party of the incumbent in the White House usually loses seats to the opposition in Congress at this halfway point of their term, but will this trend repeat itself in 2022? In this piece we take a look at the current polling statistics and discuss the potential outcome.

The Oil Market - Q4 Update: Clouds on the Horizon

As we head through the final quarter of this year, the crude market remains bullish with a range of structurally supportive factors. The outlook for 2023 however, is somewhat more cloudy with building economic and geopolitical uncertainties. In this note, we analyse the current state of the oil market and highlight key issues to watch in the months to come.

The Oil Market: Headwinds & Tailwinds

Despite the recent large-scale sell-off across most risk assets and a strong US dollar, oil prices remain entrenched above US$100 a barrel for now, driven by supply constraints and geopolitics, but headwinds are beginning to build. In this update, we discuss the current state of the crude market and highlight the issues to keep an eye on during the second half of 2022.

Egypt - 'Fresh Challenges Ahead'

Our latest update on Egypt in which we recap some its major economic achievements since 2016 and consider the new challenges it now faces.

FAB Insights: Food Insecurity & Political Risks

The lingering impact of COVID-19 continues to disrupt supply logistics which, combined with climate change and more recently the Ukraine crisis, has led to record energy and food prices. In this attached note ‘Food Insecurity & Political Risks’ we outline the scale of this problem and why it poses a serious risk to socio-economic and political stability around the globe.

FAB Insights: Oil Market - Flash Note

Crude prices are currently approaching levels not seen since 2008, while the benchmark for natural gas in Europe reached an all-time high of EUR212 per MWh at the end of last week. In our latest flash note, we discuss the current state of the oil market and highlight key risks to watch in the near term.

FAB Insights: The Ukraine Crisis

In our opinion, Russia’s invasion of Ukraine is the most important geostrategic event since the collapse of the Soviet Union in 1991, and will lead to a complete revision of foreign policy and security considerations across the globe, especially in the west. In this piece attached, we consider the impact this situation is having from an economic and political standpoint and why it will likely have lasting repercussions.

Key Risks in 2022

The greatest health crisis that the world has faced since 1918 severely disrupted everyone’s lives as well as the global economy in 2020/21. Admittedly this crisis is not over yet and it remains a key risk in 2022, but there are hopeful signs that it is now moving towards becoming an epidemic rather than a pandemic. Looking at the year ahead there are several other more man-made concerns to bear in mind and in this piece we try to highlight some of these.

Five Key Risks in 2024

As the old-world order continues to fade and a far more polarized one appears to be taking its place, in this piece attached we discuss five of the major risks facing us in the year ahead. While US-China relations and Climate Change, which were listed in our ‘Key Risks for 2023’ publication feature again, we also discuss a few additional challenges to focus on in 2024.

Oil Market Overview: 2023/24

After entering the second half of this year with a bullish tone, supported by a tightening global supply picture and falling inventories, crude prices slipped back in early November as demand fears re-emerged. In this research note we analyze the performance of the oil market in 2023 and discuss the outlook for 2024.

Climate Change vs Energy Security

In this piece, we have tried to briefly outline the serious risks that climate change poses to our planet. However, the transition to cleaner energy also needs to be well-planned and stable, otherwise it could put humanity at an even greater risk in the near term. Therefore whilst acknowledging the fact that climate change is a real and present danger, we also suggest that that the world will need certain fossil fuels such as oil and gas for some time to come in order to manage this energy transition correctly.

Oil Market Update – Q3 2023

As we begin the third quarter of 2023, the crude oil market remains trapped between the same headwinds and tailwinds experienced during the previous first two quarters, such as global macroeconomic concerns, supply and demand fundamentals as well as a geopolitical issues. In this piece, we analyze these issues and explain why we are still cautiously optimistic on the outlook for prices for the second half of this year.

Oil Market Flash Note – Q1 2023

As we near the end of the first quarter of 2023, crude prices have recently come under strong downward pressure; due primarily to a fresh wave of risk aversion. In this flash-note, we review the current state of the oil market and the key factors to keep an eye on going forward.

The UAE’s Clean Energy Drive

The UAE has been a pioneer in planning and implementing a clean energy program within the hydrocarbons industry, a journey that began over 16 years ago. In this piece, we look at the UAE’s various achievements in this area so far and its long-term plans to achieve net zero.

2022 Oil Market Outlook

In this publication, we discuss the key drivers for the oil market in the year ahead.

Sub-Saharan Africa - 'Ones to Watch'

Our brief analysis on three sub-Saharan countries which don’t appear often on the radar of mainstream investors, but nonetheless have an interesting socio-economic story to tell.

FAB Insights: Angola - 'Rich & Poor'

As the next general election in Angola approaches, we take a fresh look at the current state of the nation and whether any progress has been made in recent years to diversify the economy away from its decades long and heavy reliance on crude oil.

Oil Flash Note – 'Will the bulls run out of puff?'

In this publication, we discuss the latest developments in the oil market and review the outcome of the recent OPEC+ meeting.

The Clean Energy Transition - ‘A Material Question’

Our brief analysis on the clean energy transition, with a focus on some of critical materials required by the renewables sector. We also discuss how ‘rare’ and how ‘green’ are these metals and minerals and who controls them.

Crude Oil Market Update – Flash Note

In this publication, we discuss the current state of the oil market and our adjusted price outlook.

Key Geopolitical Risks in 2021

In this publication, we consider the risk COVID-19 still poses to the world and list a number of other potential geopolitical risks to keep an eye on this year

Access a Global Network

Global Markets

Our Global Markets team has the expertise to deliver best-in-class products.

Global Transaction Banking

Top tier services designed to expedite transactional activities domestically and internationally.

Global Corporate Finance

Global Corporate Finance provides specific financing alternatives and assists you in the analysis of these options.