Limited time offer

For UAE Nationals

- Campaign anticipated profit rate of up to 4.00% per year is valid only on new funds from 1 May 2023 to 31 March 2026, for individual customers

- Anticipated profit rate of up to 3.25% per year is valid on existing funds until 30 April 2023, for individual customers

- Every 25,000 monthly average balance in Islamic Savings Account gets a chance to enter the Emirati Al Awwal draw with a mega prize worth 1 million

OR

OR

OR

For Expats

Features*

Eligibility

- UAE Nationals, GCC Nationals and resident and non-resident expatriates are eligible

- Salaried, self-employed and non-salaried customers are eligible

OR

OR

- The completed account opening form

- A copy of a valid passport/residence visa/Emirates ID (originals must also be presented)

- A salary certificate addressed to FAB (issued within the last 30 days) or other proof of income for a non-salaried applicant

OR

OR

OR

Note: Additional documents may be required on a case-by-case basis.

Debit card benefits

- Get a free Islamic Mastercard debit card with a host of great features**

- Cash withdrawals from all ATMs displaying the UAE/GCC Switch logos throughout the GCC and at any ATM worldwide displaying the Mastercard/Cirrus logos

- Access to exclusive benefits and preferential treatment, allowing Mastercard Platinum Islamic Debit Card holders to move seamlessly across the world to experience the best it has to offer**

- Get airport lounge access across the region (no prior booking required, simply show your Mastercard Platinum Islamic Debit Card at reception)**

OR

OR

OR

OR

- ATM cash withdrawal limit – 20,000

- Retail purchase transaction limit – 40,000

OR

OR

Islamic Savings Account profit rates

Historical profit rates distribution:

| Islamic account type & CCY |

Profit Rate Distributed (May’22) |

Profit Rate Distributed (Jun’22) |

Profit Rate Distributed (Jul’22) |

|---|---|---|---|

|

Islamic Savings – |

0.50% |

0.50% |

0.50% |

|

Islamic Savings – USD |

0.50% |

0.50% |

0.50% |

|

Islamic Savings – EUR |

0.50% |

0.50% |

0.50% |

|

Islamic Savings – GBP |

0.50% |

0.50% |

0.50% |

- The above are the actual profit distribution rates and are indicative of rates for the current month. Profit distribution rates in future months, if any, may vary

- Currently available for an currency account only, a special anticipated profit rate of up to 4.00% per year for fresh funds from 1 May 2023 to 31 March 2026

- The anticipated profit is distributed on a monthly basis

- To view the historical profit rate distribution for previous years, click here

*Terms and conditions - Islamic Savings Account for UAE Nationals.

**These features are provided by Mastercard. Please visit the Mastercard website for details.

Features and eligibility are subject to change from time to time at the Bank’s sole discretion.

Find out more about our Fees, Terms & Conditions

Click here to view all the Islamic banking fees and charges

PDF

The Shariah rulings ('Fatwa') issued by FAB ISSC for Islamic Savings Account (Mudarabah)

PDF

Terms and Conditions – Islamic Savings Account Campaign

PDF

Click here to view the Key Fact Statement

PDF

Mudarabah Islamic Savings Account and Investment Deposits Financial Disclosures

PDF

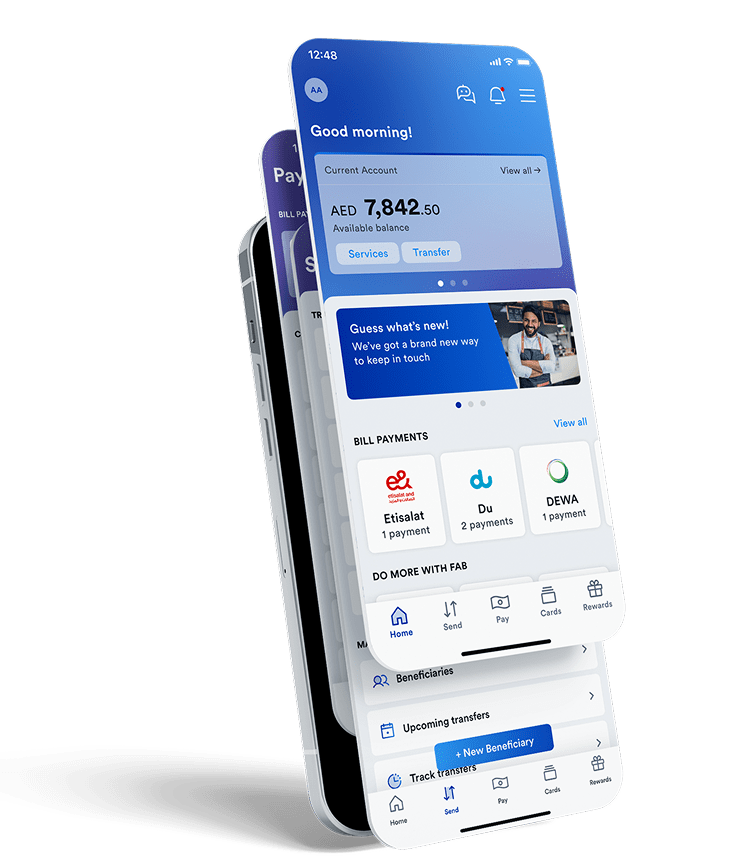

Open an Islamic Savings Account instantly on the FAB Mobile app

FAB Mobile puts the power of the bank in your hands

- Get your FAB account and Islamic cards instantly. Zero paperwork

- Open an account and get an Islamic card, with just your Emirates ID

- Use your FAB Rewards to pay your bills anytime, anywhere

- Check your balance, send money and earn rewards in a few taps

Need more help? Get in touch

Contact us anytime for further assistance or check out our FAQ page for more information.

| FAB Islamic | International | ||

|---|---|---|---|

|

800 2200 Lines Open 24/7 |

+971 2 499 6299 | ||

| Email Us | |

|---|---|

| islamiccustomercare@bankfab.com | |