During a particularly challenging year marked by significant market disruptions, FAB’s Corporate and Investment Banking Group achieved a solid performance, leveraging our regional expertise, market-leading product platforms, superior credit ratings and financial strength to provide support to our clients and help them successfully navigate unprecedented conditions.

Against the turbulent and uncertain backdrop of 2020, FAB showcased strength, resilience and adaptability while supporting our customers, employees and communities in navigating unprecedented times.

We focused not only on the immediate challenges created by the pandemic, but also on positioning ourselves for future success, making significant progress against our strategic agenda, accelerating our digital transformation journey and unlocking value for our stakeholders.

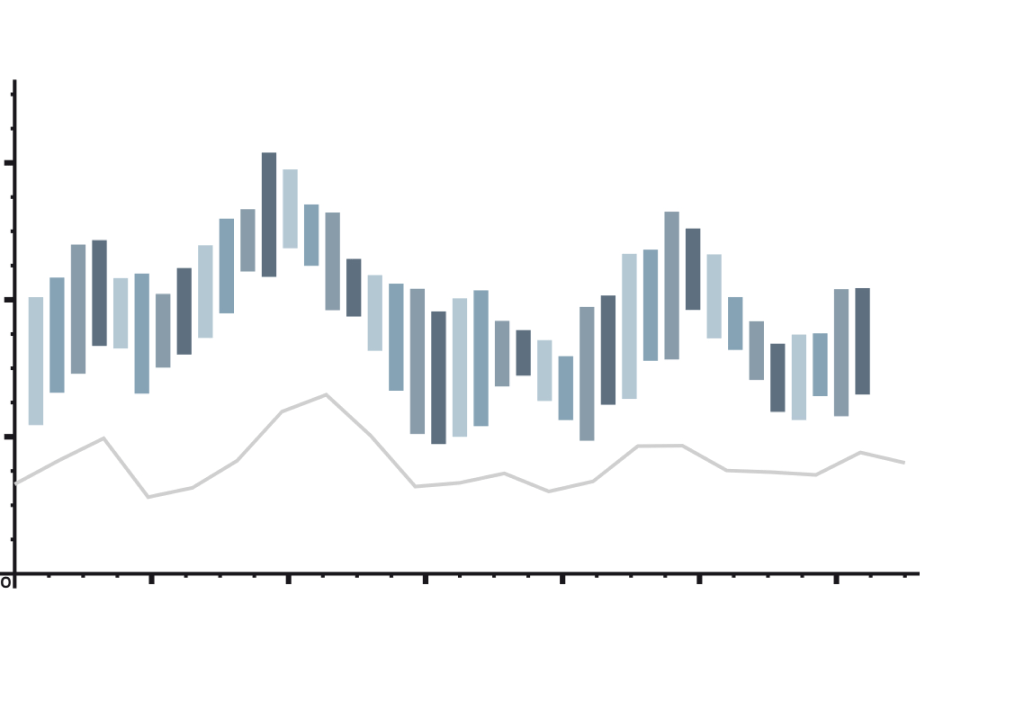

Key Financial Highlights as of 31 December 2020

A resilient performance during an unprecedented year

AED 919 billion

(USD 250 billion)

Total Assets +12% YoY

AED 387 billion

(USD 105 billion)

Loans and Advances

+2% YoY on an adjusted basis

AED 541 billion

(USD 147 billion)

Customer Deposits

+11% YoY on an adjusted basis

AED 141 billion

(USD 38 billion)

Market Capitalisation

-15% YoY

AED 18.6 billion

(USD 5.1 billion)

Revenue

-8% YoY

AED 10.6 billion

(USD 2.9 billion)

Net Profit

-16% YoY

fils 74 per share

Cash Dividend

2019: 74 fils per share

FY'20 Revenue: AED 18.6 billion (USD 5.1 billion)

Corporate and Investment Banking

Personal Banking

Head Office and Subsidiaries

FY'20 Revenue: AED 18.6 billion (USD 5.1 billion)

UAE

International

13.0%

(FY' 19:16.1%)

Return on Tangible Equity

27.0%

(FY' 19:26.7%)

Cost-income Ratio

3.97%

(Dec' 19:3.23%)

NPL Ratio

95%

(Dec' 19:93%)

Provision Coverage

143%

(Dec' 19:129%)

Liquidity Coverage Ratio

13.3%

(Dec' 19:13.5%)

Basel III CET1

We look back with pride on a year of leadership, collaboration and achievement

January

- Awarded “Best Trade Finance Provider in the UAE” by Global Finance

- Issued a USD 500 million five-year Sukuk, which opened the MENA Financial Institution debt capital markets as the first issuance of 2020

- Partnered with Alipay, China’s largest online and mobile payments provider, to help UAE merchants unlock more business opportunities

February

- Raised over AED 3 billion across three days via the region’s first Financial Institution Sterling bond and FAB’s first Kangaroo bond since 2014

March

- Implemented support measures for diverse stakeholders in response to COVID-19

- Activated Business Continuity Plan with gradual shift to “Working from Home”, reaching up to 95% of eligible employees

- Provided laptops worth AED 5 million to UAE students to support distance learning

- FAB’s Global Corporate Finance Securities Services facilitated the UAE’s first ever online Virtual General Assembly Meeting (GAM)

- Launched innovative “payment-as-a-platform” service for merchants, consolidating a full range of payment needs into a single, digital-first package

- FAB’s payit wallet partnered with Mastercard

April

- Launched fully contactless digital invoicing solution for SME merchants in partnership with Etisalat Digital

- Awarded “Best Debt Bank in the Middle East” by Global Finance

June

- Issued HKD 750 million five-year Green Bond private placement, which was the first Green Bond issuance by a MENA issuer denominated in Hong Kong Dollars (HKD) and the first Green Bond in HKD by an offshore Financial Institution (ex-China)

- Launched FAB eSign technology for secure digital signatures on client documents

July

- Received three Euromoney Awards for Excellence 2020: “Middle East’s Best Bank for Financing”, “Best Investment Bank in the UAE” and “Middle East’s Best Bank for Corporate Responsibility”

- FAB’s Global Corporate Finance was involved in the largest M&A deal out of the MENA region on behalf of ADNOC

- Partnered with Ministry of Human Resources and Emiratisation (MOHRE) to deliver a unified payment solution for UAE domestic workers, fully integrated with payit

- Selected by Etihad Aviation Group as payments partner for online and retail card transactions after a rigorous global tender process

August

- Issued a CNY 3.6 billion five-year Formosa, which continues to be the largest ever CNY-denominated Formosa from an offshore Financial Institution (ex-China)

- Distributed nearly AED 4 million in rebates as part of COVID-19 relief measures to over 6,000 SME merchants

September

- Launched UAE’s first in-store Buy-Now-Pay-Later offering in partnership with Tabby and Al Futtaim

- Issued USD 750 million Additional Tier 1 (AT1) capital notes with a coupon of 4.50% which was the lowest ever RegS only AT1 coupon from a MENA issuer. The issuance followed the repayment of its earlier AT1 capital notes at their first call date in June

- Awarded “Most Impressive Middle East Bank Issuer” by Global Capital

October

- At the General Assembly Meeting, FAB shareholders approved the transfer of legacy FGB banking license to ADQ in exchange for a 10% stake in their future digital bank, and preferential access to an additional 10% at the time of any IPO

- Launched Digital Marketplace through payit to support retailers, SMEs and local businesses in moving online

November

- Introduced fully digitised account opening process for UAE SMEs

- Awarded global custody mandate for Shuaa Capital to provide global custody services for its new Abu Dhabi Global Market (ADGM) funds

December

- Partnered with Visa to launch virtual card payment solutions for corporates

- Opened Jakarta office to support MENA-Indonesia trade and investment

COVID-19 Response

Starting in February 2020 and continuing through the year, the Bank acted with foresight and focus to ensure the health and safety of our employees and customers, while accelerating our digital transformation to maintain service and operational continuity.

Strategic Review

H.H. Sheikh Tahnoon Bin Zayed Al Nahyan

Chairman

“During these challenging and uncertain times, FAB has remained steadfast in the face of adversity, supporting our customers, employees and communities, and delivering on our commitment to stakeholders.”

Hana Al Rostamani

Group Chief Executive Officer

“As the leading UAE bank, FAB remained resilient in navigating the multiple challenges of 2020, reflecting our enduring commitment to the economic prosperity of our nation, and our unwavering support to our customers, employees and communities.”

James Burdett

Group Chief Financial Officer

“FAB delivered a resilient performance throughout 2020, achieving a full-year Group Net Profit of AED 10.6 billion and maintaining a robust foundation for growth in one of the most challenging years on record for our markets and our industry.”

Market Overview

The unprecedented events of 2020 have shaken economies and markets across the globe, and the subsequent measures implemented by governments around the world to stem the COVID-19 pandemic and protect public health have posed significant challenges to financial markets and businesses.

Business Model

Our robust foundation with a strong balance sheet and solid fundamentals enables us to serve our customers, safeguard our employees and support our communities, while delivering superior and sustainable returns for our shareholders.

Group Strategy

FAB’s Group Strategy defines our ambitions, focus areas and propellants. Our strategy is constantly evolving to reflect changing market dynamics and is executed with pride and precision by our diverse workforce across our operating divisions and geographic footprint.

Risk Management

FAB’s Risk Management Strategy includes our comprehensive Enterprise-wide Risk and Compliance Risk Frameworks, which are fully aligned with our Group Vision to drive consistent value for stakeholders through the optimisation of risk and reward.

Corporate Governance

As the largest bank in the UAE, FAB is committed to achieving best practice practices in corporate governance, business integrity and professionalism. Its Board-approved Corporate Governance Framework is aligned with the Bank’s strategic objectives and reflects applicable regulatory guidelines, including those of the Central Bank of the UAE and its other regulators.