FAB supported the financing of the UAE’s first major waste-to-energy plant in Abu Dhabi, a landmark project converting up to 900,000 tonnes of waste per year into clean energy. The facility generates 78 MW of renewable power and is expected to reduce 1.1 million tonnes of CO₂e annually by diverting waste from landfills.

Support the Global Transition to a Low Carbon and Nature Positive Future

At FAB, we recognize the global challenges posed by unsustainable economic practices and the resulting impact on the environment and development of prosperous and resilient economies and are committed to advancing a low-carbon and nature-positive future. Aligned with the UAE’s Net Zero by 2050 Strategy, we are taking decisive steps across our operations and financing activities to enable the transition toward a sustainable economy.

We continue to embed environmental and social considerations across our business, mobilizing sustainable finance, strengthening climate and nature risk management, and enhancing the efficiency of our own operations.

Through these efforts, FAB is driving measurable outcomes that contribute to long-term value creation for our stakeholders. FAB’s approach is guided by international and national sustainability frameworks and goals.

Our sustainability commitments

Net Zero Banking Alliance

UN Environment Programme Finance Initiative (UNEP FI) and the Principles for Responsible Banking (PRB)

Carbon Disclosure Project (CDP)

Equator Principles

Task Force on Climate-related Financial Disclosures (TCFD)

Taskforce on Nature-Related Financial Disclosures (TNFD)

Abu Dhabi Vision

UAE Vision 2021

UAE Green Agenda 2015-2030

UN Sustainable Development Goals (SDGs)

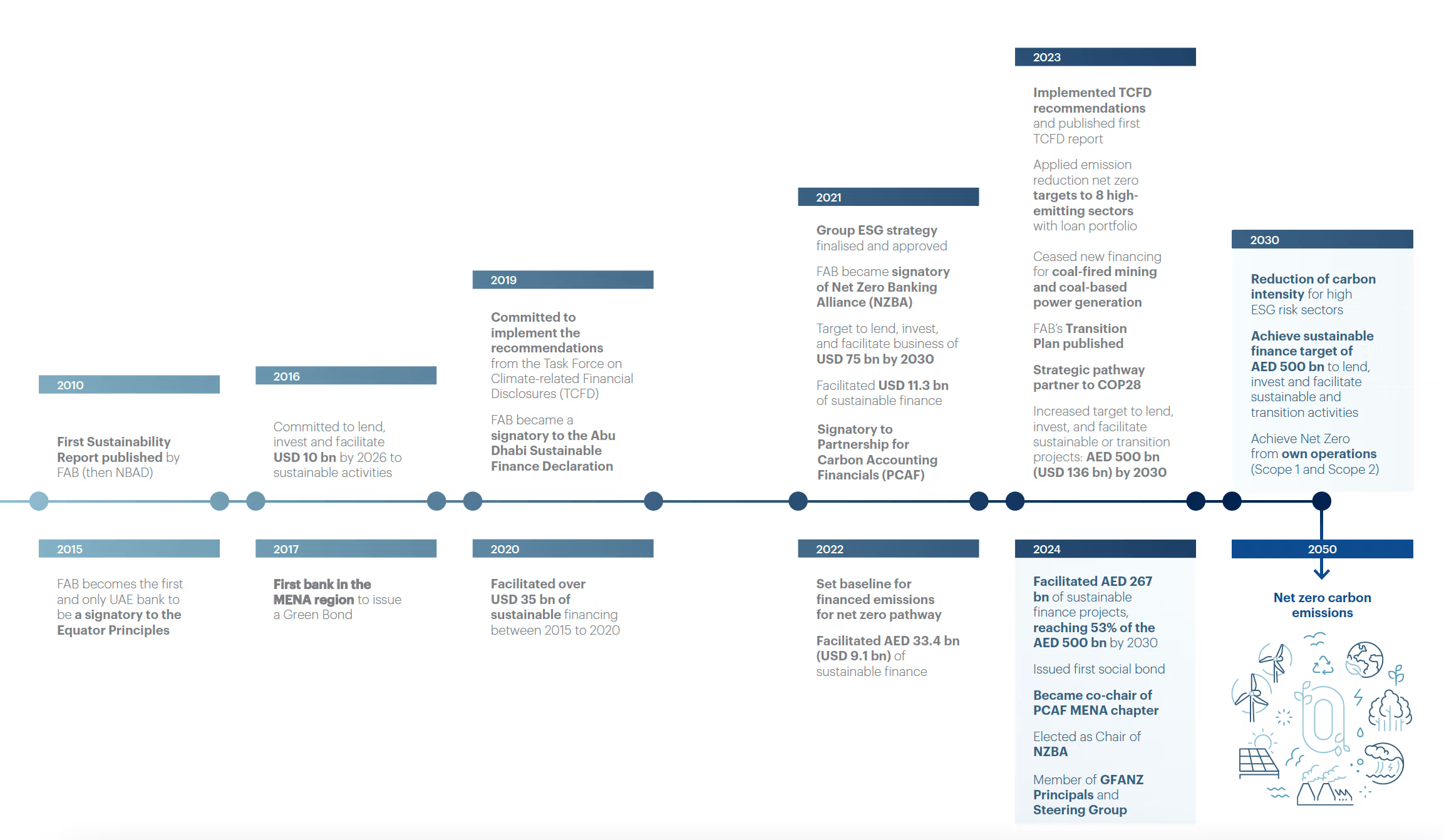

Our timeline to Net Zero

Climate

Addressing climate change is at the heart of FAB’s sustainability strategy. We’ve set ambitious targets to achieve net-zero emissions across scope 1 and 2 by 2030 and scope 3 emissions by 2050, in alignment with the UAE’s national goals and global frameworks. Through sectoral decarbonization pathways covering 90% of our portfolio emissions, sustainable financing, cross-sector collaborations and thought leadership, FAB is enabling the transition to a low-carbon economy while strengthening climate resilience across industries and communities we serve.

Managing Climate Risk

Climate risk is a critical consideration in FAB’s operations and portfolio decisions. Guided by our Climate Risk Policy and Framework, we assess sectoral transition pathways and our portfolio, to manage risks and identify opportunities. These efforts ensure our financing and advisory services support clients in navigating climate-related risks and accelerating their sustainability journeys.

Nature

FAB recognizes the vital role nature plays in sustaining economies and is committed to advancing nature-positive outcomes that protect and restore ecosystems. In alignment with global goals and the UAE’s national priorities, we are integrating nature-related considerations into our financing decisions, risk frameworks, and strategic partnerships.

Managing Nature Risk

Nature-related risks are increasingly shaping economic and financial stability. FAB has adopted TNFD-aligned disclosures to identify and manage risks linked to nature loss, water scarcity, and ecosystem decline. By integrating nature considerations into our strategy, we are supporting nature-positive pathways that safeguard long-term value creation for stakeholders.

Circular Economy

Circularity is a pillar of FAB’s commitment to sustainable growth and resource efficiency. In line with the UAE Circular Economy Policy and global best practices, we are embedding circular economy principles across our operations and supporting sustainable finance for circular solutions. By accelerating the shift from linear to circular business models, FAB is driving long-term environmental and economic value creation.

Direct environmental impact of operations

Scope 1*:

Direct combustion of fuels and refrigerants (globally, and UAE).

Scope 2:

Location based purchased electricity for own use (globally and UAE).

Scope 3:

Water consumption (global and UAE), indirect emissions from business travel (global and UAE), waste generated and recycled (global and UAE), paper consumption (global and UAE).

Our Pathway to Net-Zero

As part of our commitment to be Net Zero by 2050, we have identified and set intensity reduction targets for 8 of our high-emitting sectors, accounting for over 90% of our corporate financed emissions portfolio.

2030 Pathway

Oil & Gas

7%-15% reduction to reach 53-59 MtCO2/EJ

Power

65% reduction to reach 192 gCO2/kWh

Aviation

15% reduction to reach 71 gCO2/pkm

Commercial Real Estate

15% reduction to reach 71 gCO2/pkm

Aluminum

9% reduction to 7.4 t/

Cement

25% reduction to 0.57 t/t

Steel

23% reduction to 1.55 t/

Agriculture

4% reduction to 1.74 ktCO2e/m$

FAB’s Pathway to Net Zero and Climate reports provide a transparent view of how we are aligning our operations with our climate commitments. These reports provide transparency on our decarbonization journey, including sector-specific strategies and progress.