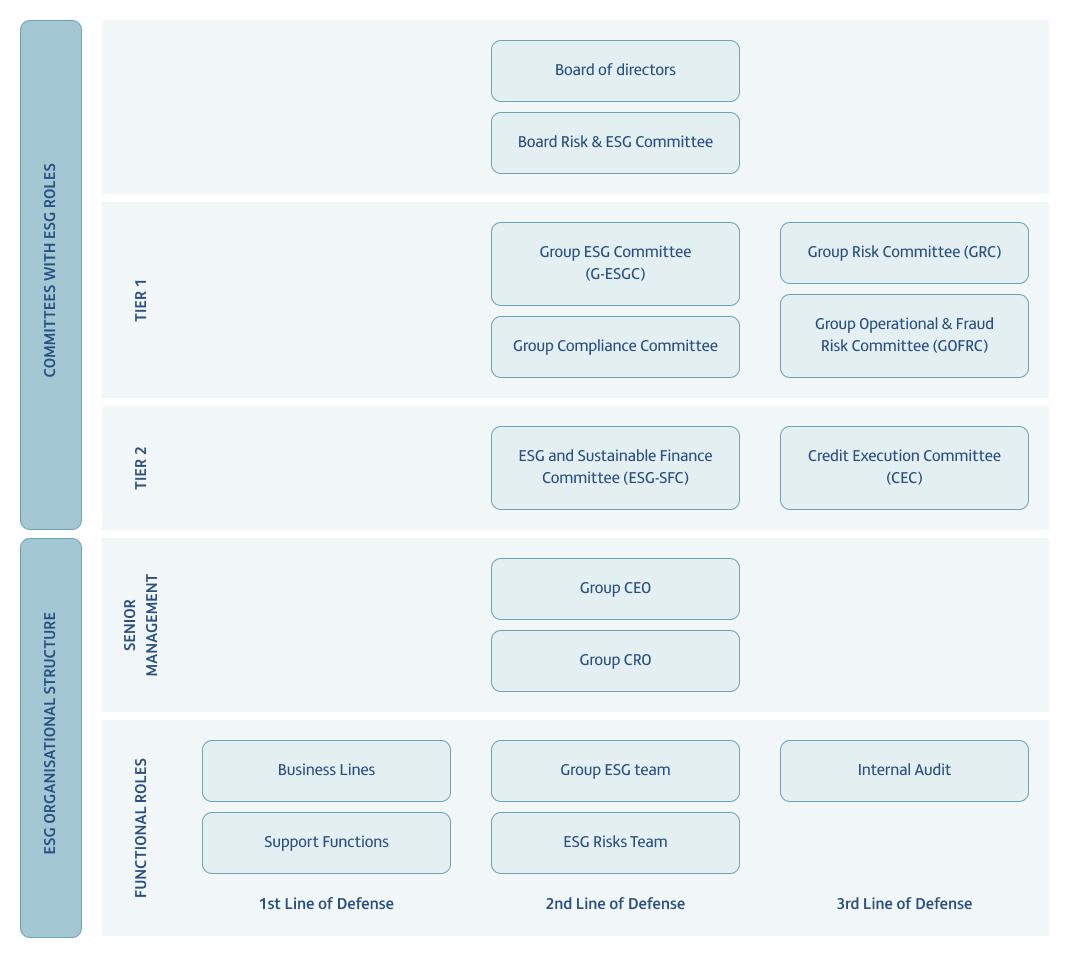

ESG principles are embedded across FAB’s governance framework, ensuring accountability, transparency, and integrity at every level.

Dedicated committees oversee the development and execution of our ESG strategy, policies, and risk frameworks. Clear mandates and structured oversight reinforce our long-term alignment with sustainability goals and global best practices.

Governance Structure

Key Governance Practices

Safeguarding Integrity & Managing Financial Crime

At FAB, we take a comprehensive approach to managing financial crime, fraud, bribery, and corruption risks. Our global financial crime unit leads efforts in fraud detection and prevention through risk assessments, product reviews, mystery shopping, spot checks, and employee education. We collaborate closely with law enforcement and financial institutions to share intelligence and strengthen collective resilience. We maintain a zero-tolerance stance on bribery and corruption, embedding robust controls across business functions and delivering targeted training to high-risk areas. All employees undergo mandatory e-learning programmes on Anti-Money Laundering (AML), Sanctions, and Anti-Bribery & Corruption, ensuring a strong culture of compliance and accountability throughout the organisation.

Customer Screening

Our due diligence process, Know Your Customer (KYC) and other client identification requirements (including a comprehensive ESG assessment process conducted in tandem with KYC) verifies legitimate customers during the onboarding process. Our deterrence and detection infrastructure include advanced tools to record, trace and report criminals and any suspicious transaction activity across channels. Regular screening of customers and counterparties occurs against listed terrorist organisations and sanctioned names issued by the UN, US, EU, UK and UAE.

Modern Slavery and Human Trafficking

FAB is dedicated to preventing modern slavery and forced labour across its operations and supply chains.

Our Modern Slavery Policy and Statement establish our governance methodology for ethical practices and responsible sourcing, financing and employment. We work to protect people and uphold human rights in all aspects of our business.

Whistleblowing

At FAB, we foster a culture of transparency and integrity.

Our Whistleblowing Policy provides a secure and confidential channel for employees, partners, and stakeholders to report any concerns about misconduct or unethical practices. We are committed to protecting whistleblowers from retaliation and ensuring all reports are investigated fairly and transparently.

Vendor Risk Management

We expect our partners and suppliers to uphold the same ethical and sustainability standards that we set for ourselves.

FAB’s Vendor Risk Management Policy ensures all third parties we work with operate responsibly, transparently, and in alignment with our ESG values. By evaluating vendor practices, we protect our business, our clients, and the communities we serve.

Data Privacy

Safeguarding data and systems are a key priority for FAB.

FAB’s Privacy Policy outlines comprehensive measures to protect against threats, ensuring the confidentiality, integrity, and availability of critical information. Through continuous monitoring and advanced security frameworks, we maintain a secure digital environment for our customers and stakeholders.