Introduction

After a year of extremes, with the fastest fall and strongest ever rebound in the history of global markets, investors are looking ahead with justifiable optimism. Record stimulus, the roll-out of vaccines to combat the coronavirus, and fading geopolitical uncertainty promise to continue to power asset prices upwards.

MENA Outlook

MENA Equities Outlook

After the UAE, Qatar, Saudi Arabia and Kuwait were included in the MSCI EM index, the GCC represents 4.6% of the benchmark. This is increasing global awareness about regional stocks at a time when there are several reasons to be bullish about them, from stabilizing oil prices, to a weaker dollar and low rates.

MENA Fixed Income Outlook

With global bond yields having fallen to levels not seen in almost a decade and the amount of negative yielding debt reaching new records, bonds in the MENA region offer attractive risk-adjusted returns in 2021. The region has also lagged other emerging markets as lower oil prices weighed on investor sentiment surrounding it, and bond spreads in the region over Treasuries could tighten during 2021.

GCC FX Outlook

The potential for a moderate recovery in crude prices over the next two years suggests many of the swaps curves in GCC FX markets are trading at relatively cheap levels and should provide good opportunities this year.

Energy Outlook

Crude Oil Outlook

This past year has been a tricky one for oil analysts, as a health crisis is a very different situation to gauge, compared to a more clear-cut economic one. However, FAB’s call in March last year for Brent crude to average USD 40/barrel in 2020 was reasonably accurate. As the pandemic begins to recede we remain optimistic that oil prices will continue to recover slowly in the year ahead, in line with the improving health of the world economy. Therefore, we expect Brent to average USD 58/barrel in 2021, and USD 65 in 2022.

MENA Sustainability Outlook

The Middle East is likely to benefit from the next leg of the global energy revolution as much as it did from the first. The region is well-poised to become one of the leading producers of hydrogen. The infrastructure to produce cheap hydrogen using renewable energy has to be built and paid for. This potential demand for financing of green projects, whether it is reducing flaring at some of the oil and gas producing units, or building the complexes producing the energy of the future, suggests sustainable finance is on the verge of a boom in the Middle East.

Africa Outlook

Egypt Outlook

Egypt was the only economy in the MENA region to record a positive growth rate last year (+2.75%), and one of just sixteen countries globally to grow by 1% or more. While Egyptian Treasury bills saw some investor flight early in the crisis, hard currency outflows have since reversed as the outlook for the global economy began to brighten.

Sub-Saharan Africa FX Outlook

A look at the Egyptian pound, the Ghanaian cedi, the Nigerian naira and the Ugandan shilling. These high-yielding currencies have weathered a storm in 2020, but as their economies stabilize and investors scour the globe for higher returns, they could return to favour.

Hunt for Yield

The Hunt for Yield

With cash deposits now paying close to zero and high-quality liquid assets having seen their yields compress sharply, the question is now: where can investors get any yield? Here is a potential roadmap, including the roadbumps to be careful about.

Private Markets Outlook

With low yields across the globe asset allocation strategies have been shifting to add more risk, and this has put private market instruments in focus. However, investors need to be prudent as to how they access this space. For example, historically, large institutional investors have predominantly focused on private equity firms with a long track record of good returns, and individual investors should probably follow their cue.

Global Outlook

G3 Currencies Outlook

The dollar could weaken further as the world economy recovers, and more investors are likely to move their attention to the higher-yielding, faster-growing jurisdictions emerging markets. Similar dynamics could also strengthen the euro.

Global Rates Outlook

A modest bear-steepening trend could continue to characterize yield curves this year, as long-term rates sell off in response to COVID-19 vaccine optimism and a subsequent improving macroeconomic horizon begins to come into view. But this steepening bias will probably be dampened by a generally modest global inflation outlook and dovish central bank bias for the foreseeable future.

Global Equities Outlook

The stars are aligned for good gains in developed world equities in 2021. Equities are not expensively valued relative to where interest rates are, and the main risk ahead for investors is that of a ‘melt-up’, with risk asset prices increasing too fast.

Global Real Estate Outlook

Early indications point to 3Q20 as likely being an inflection point in real estate capital markets. Following the sharpest drop-off in transaction volumes in recent years, direct transaction volume declines decelerated during the quarter. Now, real estate transaction pipelines are recovering globally, and offer a sense of optimism for the quarters ahead.

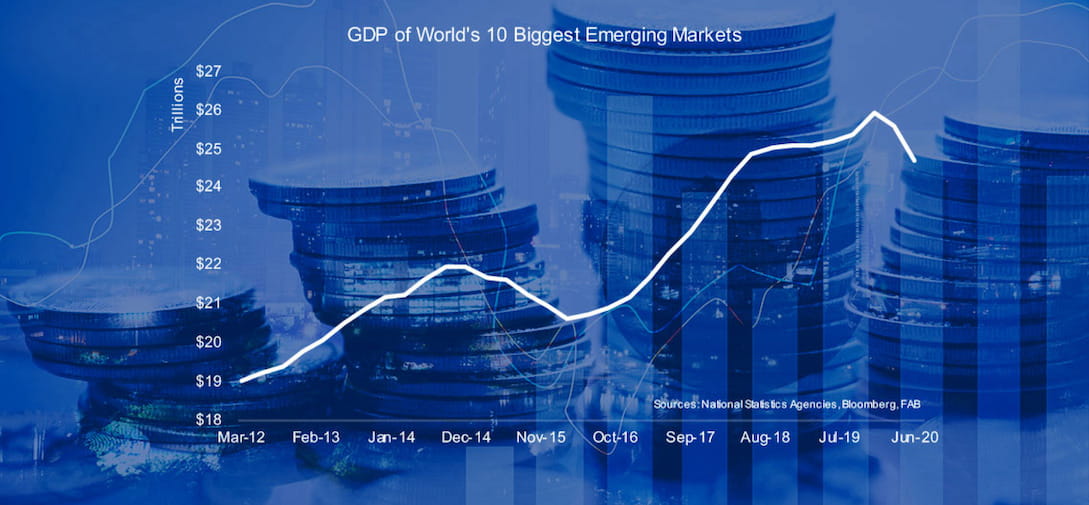

EM Outlook

Foreword

André Sayegh

Group CEO, Group Chief Executive Office

It gives us great pleasure to present First Abu Dhabi Bank’s (FAB) Global Investment Outlook for 2021. Amid the disruption of COVID-19, FAB has demonstrated strength, stability and resilience, while also playing a central part in the UAE’s economic response during unprecedented times. Through our Global Investment Outlook, we now

It gives us great pleasure to present First Abu Dhabi Bank’s (FAB) Global Investment Outlook for 2021. Amid the disruption of COVID-19, FAB has demonstrated strength, stability and resilience, while also playing a central part in the UAE’s economic response during unprecedented times. Through our Global Investment Outlook, we now look to the challenges and opportunities ahead, with FAB fully committed to achieving a strong, comprehensive and sustainable return to growth.

Hana Al Rostamani

Deputy Group CEO & Head of Personal Banking

Abu Dhabi and the UAE have worked tirelessly during 2020, continuing the drive towards economic transformation and reinforcing our status as a world-class trading hub. Given the country’s successful management of COVID-19, alongside with the rapid development of vaccines, we now see a more positive investment landscape. Our Global Investment

Abu Dhabi and the UAE have worked tirelessly during 2020, continuing the drive towards economic transformation and reinforcing our status as a world-class trading hub. Given the country’s successful management of COVID-19, alongside with the rapid development of vaccines, we now see a more positive investment landscape. Our Global Investment Outlook outlines where the investment opportunities will be this year, as we are bridging today into the future.

Jason Clark

Global Head of Products & Service, Elite & Private Banking

As we look to 2021, many economies will enter a period of stabilisation before returning to real growth, impacted by improved consumer spending, lower unemployment rates, and various stimulus measures to support the global economy. Through a combination of practical management of COVID-19, continuing improvement in the oil price, and

As we look to 2021, many economies will enter a period of stabilisation before returning to real growth, impacted by improved consumer spending, lower unemployment rates, and various stimulus measures to support the global economy. Through a combination of practical management of COVID-19, continuing improvement in the oil price, and pent-up consumer demand, many economic sectors, most noticeably tourism, leisure and real estate are expected to see signs of recovery. However, this is a complex setting where expertise and insight will be critical for identifying the right investment opportunities.

The publication of our Global Investment Outlook for 2021, seeks to begin building a bridge to these future opportunities, and we will continue to regularly update our clients as the year unfolds.