Emirates Integrated Telecommunications Company PJSC (“du”), a leading telecoms and digital services provider in the UAE whose ordinary shares are listed on the Dubai Financial Market (DFM) (DFM Symbol: du/ISIN: AEE000701012), announced the launch of a secondary public offering of its shares, increasing du’s free float and contributing to the improvement of its stock liquidity.

The price range has been set between 9.00 and 9.90 per share, representing a discount of 9.1% at the lower end of the price range compared with du’s closing share price on Thursday, 4 September 2025.

Key dates to remember

8 September 2025

Retail Subscription Period Starts

12 September 2025 (12:00 PM)

Retail Subscription Period Ends

15 September 2025

Announcement of Final Offer Price and Allocation

16 September 2025

Newly Acquired Shares Available for Trading

Subscription Eligibility Criteria

If you don’t have DFM Investor Number, you can download DFM Mobile Application to create one. Additionally, you can contact DFM.

To find out more about the subscription criteria and process, please contact your relationship manager if you are an Elite or Private banking client or call our call Centre at 026161800.

Key Transaction Documents

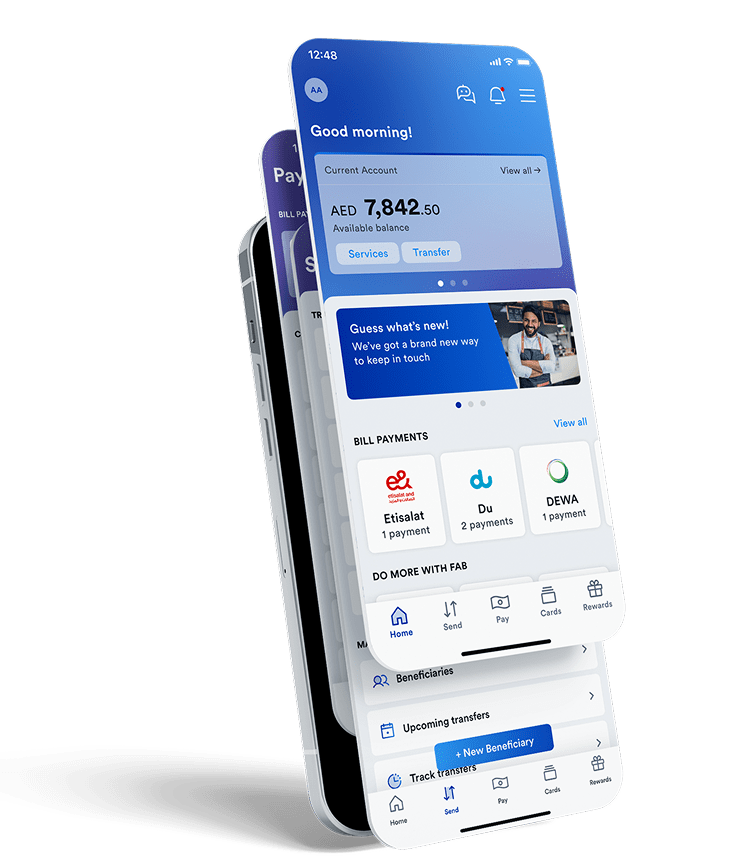

Subscribe to the Offering conveniently through FAB Mobile

Grow your wealth with FAB

- Tap ‘IPO Subscription’ under the Payments tab

- Select the ‘du’ Secondary Public Offering

- Enter your Investor Details and Amount

- Confirm your subscription

Disclaimer: This announcement has not been reviewed or approved by the SCA or any regulator in the UAE or elsewhere, does not form part of the Prospectus, and should not be considered an offer of securities in any jurisdiction. Any decision to invest in the shares should be based solely on the information in the Prospectus.