Take control of your finances – with ease.

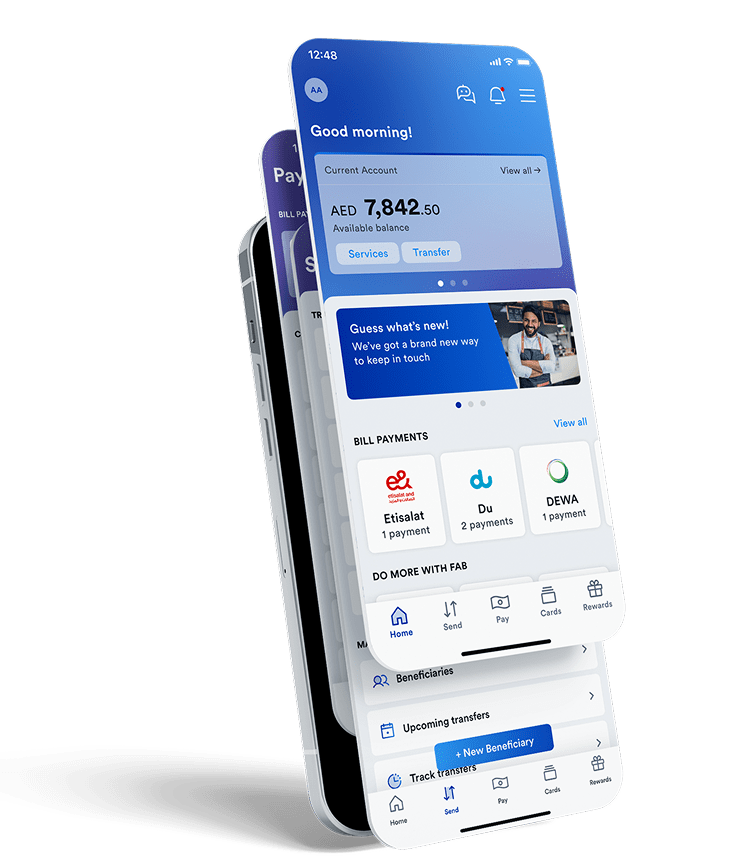

Managing your money isn’t always easy. It can be pretty overwhelming with bills, transfers and daily spends that add up fast – making it difficult to keep up. That’s why we’ve made the FAB Mobile app smarter than ever, so keeping up with your finances feels effortless.

With the app’s new features, you’ll be able to see where your money’s going, stay on top of your spending, and make smarter choices every day.

The smarter way to bank

One tap gives you total control. Track your spending, stay organised and effortlessly manage your finances with our smarter than ever banking app – FAB Mobile.

Our innovative new additions enable you to successfully handle your finances. You’ll benefit from:

Smarter Transactions

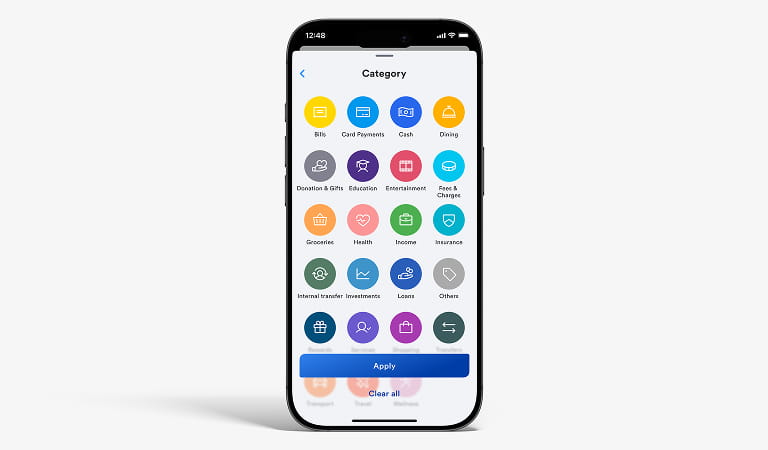

Now you don’t have to. The app automatically organises every expense into 23 categories, giving you a clear, easy-to-read breakdown - from groceries to getaways, and everything in between.

No spreadsheets, no tedious math just clarity at a glance.

Spending Insights

Sometimes, it’s the small things that make a big difference.

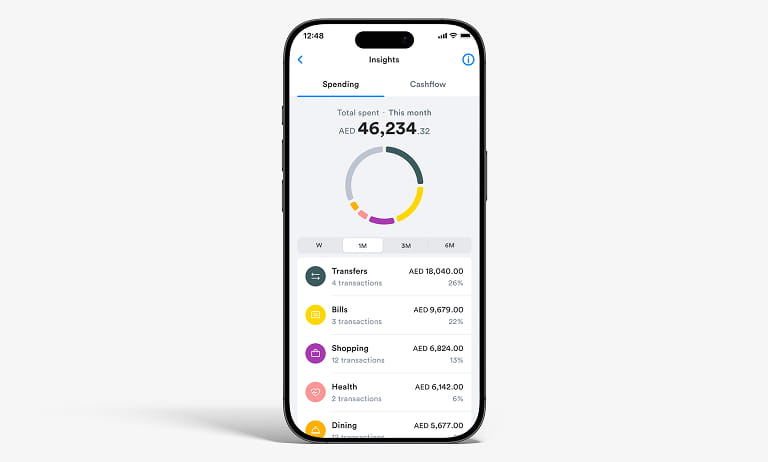

Our Spending Insights feature gives you weekly and monthly snapshots of where your money’s going - helping you spot trends, plan ahead, and feel more in control.

No surprises. Just smarter spending, one tap at a time.

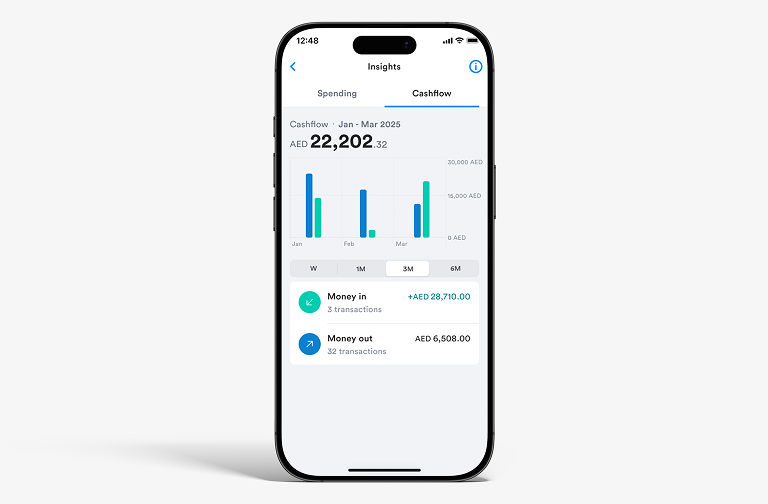

Cashflow Insights

Money in, money out- it all adds up.

With Cashflow Insights, you’ll get a complete picture of your financial health in real time. See how your spending habits and income change over time and understand what’s working (and what’s not) for your budget.

Think of it as your money story, told simply.

Real-Time Alerts

Wouldn’t it be nice if your app could give you a little nudge before you overspend?

That’s exactly what this does. Get personalised alerts that help you decide when to save and when it’s okay to spend a little more.

It’s like having a money-savvy friend who’s always got your back.

Take a look at some of our frequently asked questions

We've introduced a cleaner, more visual look for transactions so you can clearly see where your money goes. You will now see your transactions with real merchant names, logos, and sorted into spending categories instead of unclear codes. It’s a clearer, more helpful way to see where your money goes.

Each payment is automatically grouped into one of 23 spending categories such as Groceries, Dining, or Utilities.

If a transaction can’t be matched, it appears under “Others.” You can change a category yourself, and the app will remember your choice for future transactions.

Some merchants and service providers don’t share their information right away, or we may still be adding them. As soon as their details become available, they’ll appear automatically.

Yes. All transactions from 1 March 2025 have been updated with clearer details such as merchant details, logos and categories. Some recent payments may still take a little time to appear if the merchant hasn't shared its information yet.

Some payments appear only after the merchant confirms them. While they’re being processed, you’ll see them under ‘In Progress’ if you’re using a credit card, or as ‘Amount on hold’ if you’re using a debit card. Once confirmed, they’ll appear in your transactions list as usual.

Yes. You can manually change any transaction’s category directly from the app. Open the transaction details and tap Change next to the category.

Yes. Once you update a category, future transactions from the same shop will automatically use your chosen one.

Yes. Any change you make in the app will automatically appear everywhere. It will stay updated for future transactions from the same merchant until you change it again.

No. Changing a category only affects how your transactions are shown in the app. It does not impact your account balance or statements.

You can search and filter your transactions by date, category or amount. To view transactions for a single day, set the start and end date to be the same. You can also search using an amount, merchant name, or card type for keyword-specific results.

You can view transactions dating back to 1 March 2025.

Spending Insights give you a full breakdown of where your money goes. See your transactions sorted into categories, with the total value of your spending across these categories. You can see your spending patterns in weekly or monthly views - giving you better awareness and control over your spending.

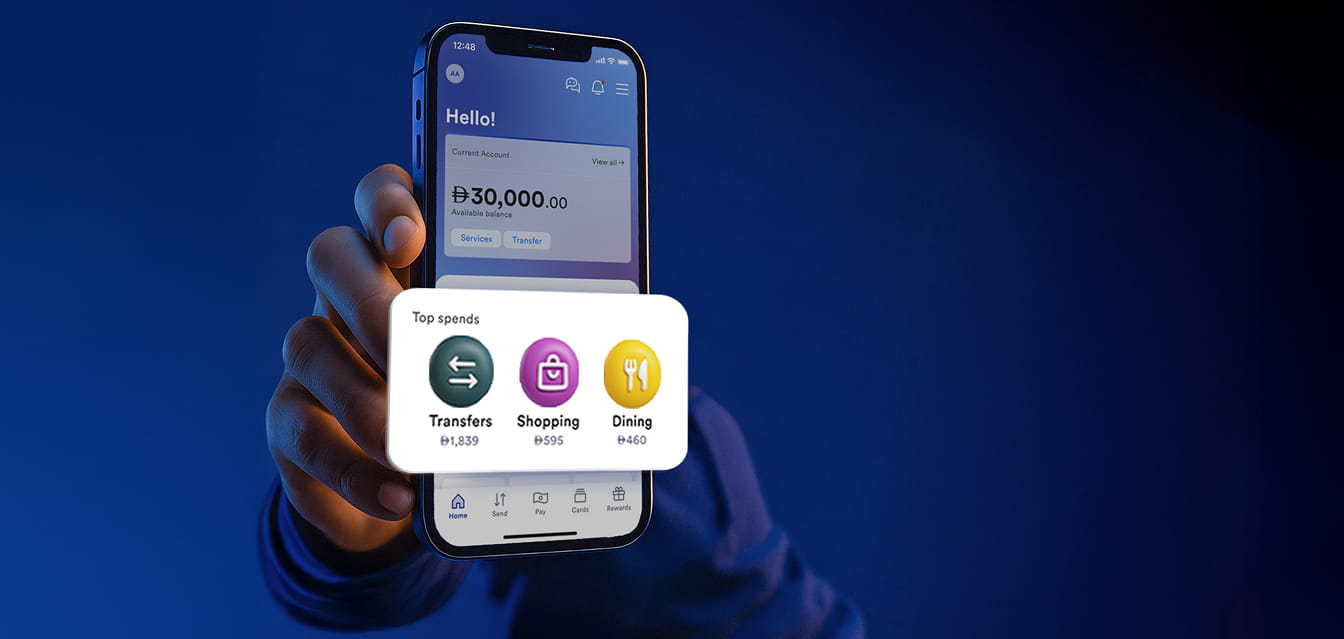

You can view your top 3 spends on your app home screen. You can access Insights by going to Main Menu > Insights, where you can explore your spending categories and cashflow in detail.

Yes. You can choose between weekly and monthly views (1, 3 and 6 months), to explore short-term activity or long-term trends in your spending.

Your spending is automatically sorted into 23 categories such as Bills, Groceries, Dining, Shopping and Travel. If a transaction appears in the wrong category, you can change it, and the app will remember your change for future transactions.

Cashflow gives you a clear view of all the money coming in and going out of your account. It shows your income, expenses and transfers together so you can understand your financial flow and plan ahead with confidence.

Spending Insights focus on what you spend and where. Cashflow combines that with your income and transfers, giving you a complete overview of both inflow and outflow, so you can see your full financial picture in one place.

Yes. You can switch between weekly and monthly views (1, 3 and 6 months), to spot the patterns in your income and spending.

Real time alerts are instant notifications that give you helpful insights about your spending, saving opportunities and financial activity. They keep you informed and help you make smarter money decisions right when it matters.

You'll receive real time alerts as push notifications or inbox messages under Alerts. Occasionally, you'll also find them under your transaction details.

You could turn off alerts by going to Settings > Notification Settings under the main menu. However, these alerts are designed to give you valuable insights based on your actual spending patterns - they only notify you when there's something meaningful to share. We recommend keeping them on to get the most value from your banking experience.

Real time alerts are based on your spending activity. You'll only receive them when we have something meaningful to share - like unusual spending, saving opportunities, spending trends and so on. We keep notifications relevant and useful, not overwhelming.