Let’s look at different types of financial services products and their uses, so you can know more about financial planning, budgeting and where you can get financial help and advice. We will look at:

This video will include:

- The purpose of financial management

- Developing a personal budget plan

- Steps to manage a personal budget using the FAB budgeting app

- The financial planning process

- When and how to seek financial help and advice

Have you ever asked yourself:

How can I make my money go further?

Why would a budgeting app help me with my money management?

Where can I go for financial help and advice?

Master how to manage your money

Managing your money is about deciding how to use your income to achieve your financial goals based on your monetary situation and life stage.

Good money management and making good financial decisions has positive benefits for you and those around you such as:

- Better relations with family and friends.

- Using money more wisely and not compromising your future financial plans.

- Having a more stable financial future and peace of mind to deal with unexpected life events in the future.

Budgeting day-to-day tools

Be on top of your budgeting

A budget is a financial plan that shows a person’s income and outgoings for a defined period, such as one month. The main objective of a budget is to provide information that helps people to take control of their finances and make decisions like:

The main parts of a budget are income, expenditure over a specific period, and the difference between the two figures, which is the balance.

Income means money received and includes money from all sources including earned and unearned.

Expenditure means outgoings and includes money used to make payments, to repay borrowing and, or to save. Expenditure falls into three broad categories: mandatory, essential, and discretionary.

Mandatory expenditure

Mandatory expenditure means the payments are compulsory; they do not necessarily apply to everyone but if they do apply, they must be paid. Examples include medical and motor insurance.

Essential expenditure

Essential expenditure is spending on items that people need to live and includes rent or mortgage repayments on a home; food and drink; utilities (water, electricity), basic clothing and travel that enables people to earn their income.

Guard your record! Loan repayments are also an essential expenditure if people want to maintain a good credit history. People who have made frequent late payments or defaulted on borrowing products may find it difficult to obtain credit in the future.

Discretionary expenditure

Discretionary expenditure is voluntary spending on products and services that people want now, and saving towards items that they aspire to buy in the future. These items include fashion items, meals in cafes and restaurants, cinema tickets, music downloads, games, gifts, hobby equipment, holidays and other desirable but non-essential items.

Steps to building your budget

It is helpful to set out a budget so that income is at the top and expenses are deducted in order of priority – that is, mandatory, essential and discretionary with the balance at the bottom. Setting out a budget in this order allows you to identify which expenses you have no choice over and which you could change.

An example budget for Osama.

| Income | 27,000 | |

|---|---|---|

| Expenses Type | Expenses | Cost |

| Mandatory expenses |

Car insurance | 150.00 |

| Road toll |

150.00 | |

| Essential expenses |

Mortgage repayment |

4,000.00 |

| Buildings and contents insurance |

70.00 | |

| Life cover to repay mortgage |

80.00 | |

| Life cover to protect family | 250.00 | |

| Water supplier |

500.00 | |

| Gas and electricity supplier |

850.00 | |

| Telephone (landline) |

360.00 | |

| Own mobile |

300.00 | |

| Car loan repayment |

1,300.00 | |

| Petrol |

600.00 | |

| Discretionary expenses |

Saving for gifts and emergencies |

3,500.00 |

| Day-to-day expenses |

2,500.00 | |

| Cafes |

400.00 | |

| School Fees |

3,500.00 | |

| Charity |

200.00 | |

| Total Expenses | 18,710 | |

| Balance (income minus expenses) | 8,290 | |

The balance on Osama’s budget is 8,290. In practice, he sometimes has a few dirhams more left at the end of the month and sometimes he has a few dirhams less. This is because the amounts he spends on petrol and day-to-expenses can vary a little from month to month. Osama’s goal is to balance his budget, so he aims to keep his spending within the amounts listed on his budget.

Monitoring Incomings and Outgoings

Once you have planned out your budget, your next step is to monitor your actual incomings and outgoings to see if you want to change your budget and / or your financial habits.

Dealing with a debt deficit

Mariam chose to borrow 300 a month on an overdraft when her budget was in deficit. Her essential living expenses plus her discretionary spending on socialising and fashion were greater than her income. When Mariam found that she could not repay her borrowing easily she decided to reduce spending and spread the cost of repaying her debt over a longer period.

If people decide to reduce spending, they are more likely to be able to cut back on discretionary spending than essential spending. Even within the essential spending category, however, they may be able to reduce costs – for instance, by spending less on food.

Try this!

Follow the “50-30-20” budgeting philosophy. It is a simple and efficient tool for budgeting, saving and spending. The philosophy includes 50 percent for "needs” or essential expenses, “wants” should make up another 30 percent, and savings and debt repayment should make up the final 20% of the budget.

FAB’s Useful Tips on How to Save Money in the UAE: Get the best out of your savings and investments | FAB - UAE (bankfab.com)

- Increase AC temperature by 1°C to lower cooling bills

- Negotiate your rent at the time of renewal

- Browse discount websites for deals

- Pack lunches for school and work

- If you order take-out on apps, filter for offers

- Buy pre-loved items whenever you can

- Plan big purchases around Ramadan, GITEX and Dubai Shopping Festival for great deals

Cashflow Forecasting

Budgets tend to focus on one time period like one month. You can use cash flow forecasting to predict incomings and outgoings over several time periods for example, three or six months or one year, to identify:

Main features of a budgeting app

- Creates a holistic money management system

- Create a plan to help pay off any outstanding debts

- Careful tracking of all bills

- Provides a succinct dashboard to give a solid, real-time overview of your finances

- Identifies any monthly spare amount to put into savings

The benefits of using a budgeting app

- Easy to use

- Organise your income and expenditure details

- Helps you to save more by stopping unnecessary expenses

- Easy to find mistakes with data entry

- Motivates you when your finances are under control

- Helps you become more confident to make financial decisions

Financial Planning

Financial planning should be considered in a medium-term (a few years) and long-term context (10 years or more e.g. retirement saving). Financial planning shows how a financial plan can be used to achieve set objectives while being able to flex to your circumstance.

How long-term objectives affect saving and spending decisions now

Mohamed bought his flat last year and is now making monthly mortgage payments of 3,500. His mortgage is a variable-rate and he knows that if interest rates rise, his repayment will rise so he tries to budget for 4,000 a month. The mortgage repayments are now an essential expenditure and they mean that he has less money to buy other items.

Features of Effective Financial Planning

Drawing up and monitoring a medium-term or long-term financial plan does not have to be a difficult or a time-consuming task. Here are the five features of effective financial planning:

Personal Financial Portfolio

Your financial portfolio is personal to you and will include your assets like:

- Your house and car

- Savings and bank accounts

- Your pension savings

- Investments, loans and other debts

Having planned your budget and set your financial plan you should be in a better position to consider aspects of your personal financial portfolio that can help you manage your money or plan for current, medium and longer-term financial plans.

Different financial products and services can be divided into key categories:

| Service Transactions | Save | Invest | Insurance | Borrowing |

|---|---|---|---|---|

|

|

|

|

|

Islamic financial Products

The term “Islamic Finance” or “Shari’ah Compliant Finance” (and other similar terms) are commonly used to refer to the contemporary financial industry that has set compliance with Islamic commercial law as one of its main criteria in the day-to-day operations.

The Islamic Finance industry is growing at an accelerated pace, exceeding US 2.44 trillion in assets globally, and recording a growth rate of 11.4%. The Islamic Finance industry is primarily manifested in banking, insurance (Takaful) and asset management sectors.

The UAE has a well-established Islamic financial industry, comprising Islamic banks, Islamic banking windows, Islamic finance companies and Islamic insurance (Takaful) companies.

CBUAE | Islamic Finance (centralbank.ae)

| Islamic Accounts | Islamic Cards | Islamic Finance |

|---|---|---|

|

|

|

Guided by Shariah principles such as Murabaha, Ijarah, and Mudaraba and supervised by the Internal Shariah Supervision Committee, FAB Islamic banking window offers a wide range of world-class products and services that address customers’ needs through Islamic financing and investment instruments while abiding by Shariah rules and principles. Islamic Personal Banking | FAB - UAE (bankfab.com)

Let’s break down bank accounts

One of the main banking products you are likely to have is a bank account. The main types of bank account are current accounts. The benefits of opening an account include:

Current accounts can now be opened quickly and simply like the FAB personal current account, which offers a free debit card, get FAB Rewards, check your balance, send money and earn rewards in a few taps.

Personal Current Account | FAB - UAE (bankfab.com)

Tips for managing your account:

- Ensure you have sufficient funds to pay for cheques and transactions that are due.

- Use statements that are provided online, on paper and via ATMs to monitor your transactions.

Why save?

Saving is so important. It helps you deal with unplanned events. These might be positive or negative, but it is a good idea to have savings, so you avoid the stress of worrying. Once you have your Emergency Fund in place, which should be 3-6 months of mandatory and essential expenditure, you should consider having a regular savings.

Setting target saving goals per month will help, and it is recommended that this at least 10-15% of your monthly income.

Tips on choosing savings accounts

- Distribute your savings among short/ medium/ and long accounts

- Make sure to leave a good amount of money in current accounts to have enough to cover essential spending

- Look for a good interest rate across different banks, compare using the AER interest rate

Do you know about the return on savings - the interest rate?

- The higher the interest rate paid, the more you, as a saver, will earn on your money

- Some banks pay it monthly; others pay at the end of the year. To compare these would be like comparing apples and oranges

- An annual equivalent rate (AER) is the rate if interest was paid once a year, it is set by the provider

- Providers set the AER on a particular product in relation to the UAE Central Banks EIBOR rate and the savings rates offered by other providers in the market

Navigating the different savings accounts that might be right for you can be daunting. Banks like FAB provide easy comparison tables on their website so you can quickly see the features of different savings accounts, important points like the interest rate and any restrictions on withdrawing money. They also link clearly to the terms and conditions that apply. Visit Saving & Investment Opportunities for New Customers | FAB - UAE (bankfab.com) for a comparison of all our savings accounts.

Investing

Investments have some key differences to savings but they can provide a much higher return than savings over the same period. While there are many different types of investments, typical investment products include Stocks and Shares, Mutual Funds, Fixed Income Bonds (For example: National Bonds) and Corporate and Government Bonds.

The differences between savings and investments

| Savings products | Investment Products |

|---|---|

|

|

Tips to manage risks

- Hold a diversified stock portfolio for companies with different features (industry type, size, stock type)

- Invest for the long term to avoid short-term fluctuations

- Don’t try to time the market as climbing stocks attract more buyers that drive prices higher, prices can fall just as fast as investors start to sell to cash in on the big gains

- Get advice if you’re not a knowledgeable investor

Stay covered with insurance

Insurance is a payment ‘just in case’ something unexpected happens. We pay insurance companies because if something bad does happen, it will cost lots of money to deal with it ourselves. A person buys an ‘insurance policy’ from a company that agrees to take on certain risks in return for a premium. Insurance products are provided by Insurance and Takaful companies.

| Compulsory insurance | Voluntary insurance |

|---|---|

|

|

Insurance offers a wide range of benefits

At FAB we offer a range of insurance products.

Borrowing

There is a wide range of borrowing options for you to choose from designed for different purposes. You should think very carefully about your borrowing needs and choose a form of borrowing that is right for you.

Loans typically fall into two categories

| Unsecured Loans | Secured Loans |

|---|---|

|

|

You should also read the terms of your loan very carefully as you might be charged a fee or penalty for early repayment, going into arrears by not meeting your loan repayments will have a negative consequence for your credit rating and you will pay more in interest and charges if you extend the term (duration) of your loan.

A loan calculator can help you assess if you are eligible for a loan and how much it might cost you to pay back. Use the FAB Loans Calculator

Calculate Your Debt Burden Ratio

Use the FAB Debt Burden Ratio (DBR) Calculator by entering the repayments of your loans, mortgages, or credit card installments, and calculate the ratio of your total payments to your total income.

Indicative Personal Loan Calculator

Enter your monthly income and expenses for each category, and the Personal Loan Calculator will estimate the monthly EMI amount.

Indicative Personal Loan EMI Calculator

Calculate your monthly installment by entering your income and expenses for each category. Our Personal Loan EMI Calculator will do the rest.

You can also calculate your Debt Burden Ratio. Providers of loans determine your Debt Service Ratio (DSR), which is regulated by the Central Bank of the UAE to avoid over lending to consumers.

The need for financial advice

It is important that as you plan your finances and make financial decisions for the short, medium and long-term that you have financial help and advice. But it is important to be able to distinguish between good, comprehensive advice and information that is biased and driven by the need for an organisation or its representative to sell a product.

Read more with this example

If you have chosen to borrow money on a credit card, you need to know how and when you are expected to make payments and how much you should pay each time. The credit card statement will give you a minimum payment to make each month, but if you pay only this amount, your bill will increase significantly as interest is added on. An informed consumer will know that it is best to pay off as much as possible each month since the interest rate on credit cards is quite high.

Making a bad financial choice can have unfortunate consequences, although with short-term products, such as a current account or instant access savings account, it is easy to switch to a different one. But medium-term and longer-term products – long-term savings accounts and mortgages for instance – are relatively inflexible and you will need to know financial product related facts before committing yourself. You can experience problems with financial purchases if you do not understand the agreement you are making.

While the UAE law provides some protection against bad advice and the selling of unsuitable products, consumers should remember that there is always a risk and seek guidance or advice.

Read about how changes in circumstance affect product suitability

Two years ago, Mohamed was earning a high salary and he started a regular savings plan into which he agreed to make large monthly payments. He recently lost his job; although he now has a new job, the salary is lower. He can no longer afford the payments into the savings plan but the product does not allow him to make smaller payments. He has to freeze the plan and pay a penalty.

Government help and advice

The UAE Cabinet approved a federal law concerning the insolvency of natural persons in the recent years. The federal law protects Emiratis and residents in debt from legal prosecution and decriminalises their financial obligations, offering them an opportunity to work to remove themselves from debt and support their families. The law concerning the insolvency of national persons supports individuals who are facing existing or anticipated financial difficulties that make them unable to settle their debts. At the same time, it helps individuals reschedule their debts and give them the opportunity to take new concessional loans.

The law protects the debtors from legal prosecution, decriminalize the financial obligations of the insolvent person and give them an opportunity to work, be productive and provide for their families.

Throughout the process, one or more experts will be appointed by the court to settle the financial obligations debtor. The expert will coordinate with the debtor and creditor to come up with a plan to settle the financial liabilities within three years.

The law, which complements existing financial laws, will contribute to increased transparency, in terms of civil debt repayment transactions, and will ultimately strengthen the UAE's position as an ideal hub for investment, where the rights of all parties are guaranteed.

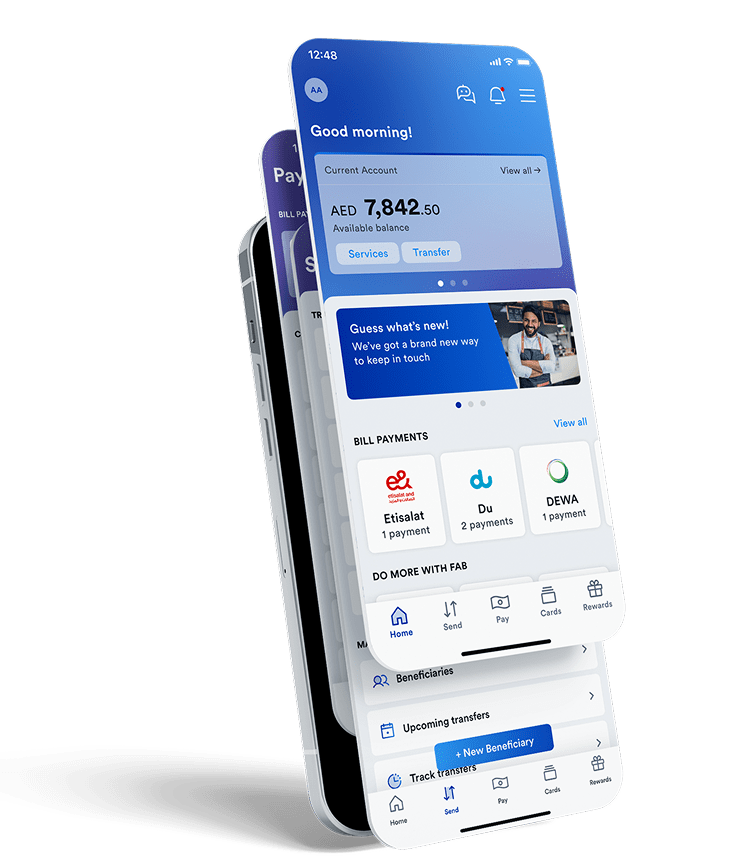

FAB Mobile puts the power of the bank in your hands.

Spend, save and stay on top of your everyday transactions, from just about anywhere.

- Manage your account, debit & credit cards

- Sign up for a product instantly on FAB mobile

- Enjoy exciting benefits

- Manage your payments

- Pay the easy way with Apple Pay