5,000

Minimum Monthly Salary

300

Annual Fee

Key Features

Exclusive Benefits

Lifestyle Benefits

Travel Benefits

| Spend segment & (MCC) | Cashback % | Monthly Cap - UAEN | Monthly Cap - Expat |

|---|---|---|---|

| Supermarket (including online) | 5% | 200** | 150** |

| Fuel | 5% | 200** | 150** |

| Dining out |

5% | 200** | 150** |

| International/ non-AED Spend |

3% | No Cap* | No Cap* |

| All others retail spending (as approved by Shari’ah) | 1% | No Cap* | No Cap* |

| Selected categories |

0.15% | No Cap* | No Cap* |

| Total monthly cap on cashback | - | 1,500 | 1,000 |

*Subject to monthly limit cap.

**Cashback is capped at 200 for UAE nationals and 150 for Expats each on fuel, dining out and groceries.

A minimum spend criteria of 3,000 per month to be eligible to earn cashback.

Warning

- If you make only the minimum payment for the amount due, it will take longer and cost more to settle your outstanding balance

- If you fail to pay the minimum payment by the due date, you will be committed to pay a donation amount based on the bank’s request (if any) and may impact your credit rating as reported to Al Etihad Credit Bureau

- If you fail to pay the minimum payment by the due date, the Bank will commence the recovery and collection process (which may include engaging third party debt collection agencies) and legal action including bankruptcy

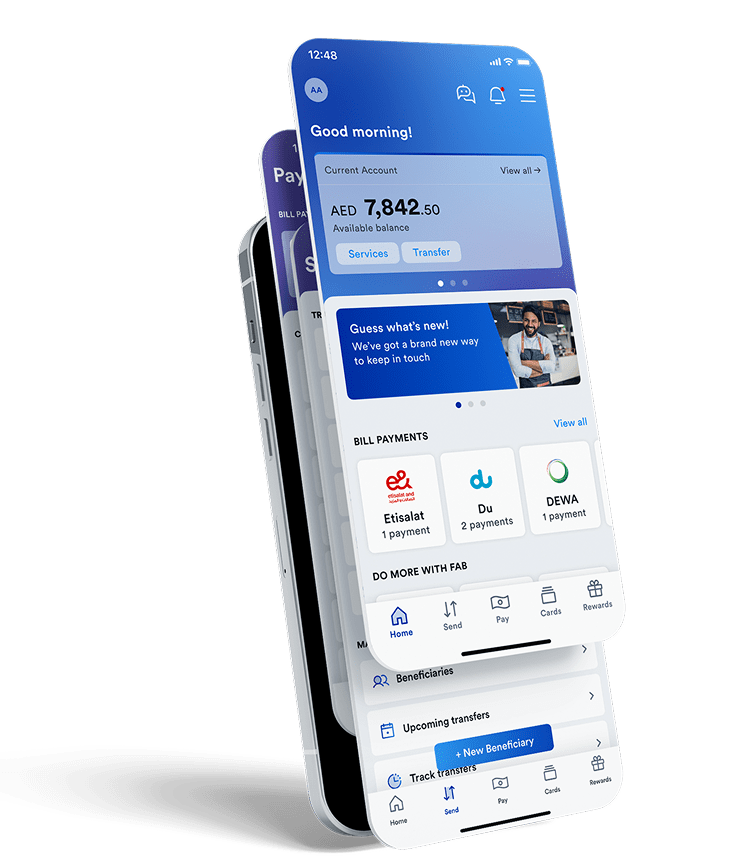

Get your credit card faster on the FAB Mobile app

FAB Mobile puts the power of the bank in your hands

- Get your FAB Islamic account and Islamic credit cards with just your Emirates ID.

- Use your FAB Islamic Rewards to pay your bills anytime, anywhere.

- Check your balance, send money and earn rewards in a few taps.

- Scan the code and choose FAB Islamic to apply for your new account or card faster.

Need more help? Get in touch

Contact us anytime for further assistance or check out our FAQ page for more information.

| For customers within the UAE | For customers outside of the UAE | ||

|---|---|---|---|

| 600 52 5500 | +971 2 681 1511 | ||