When you get a new FAB Islamic Credit Card and start spending, you could receive 20 times the amount you spend credited to your account. You will have the chance to get up to 500,000.

30,000

Min Monthly Salary

2,500 (Excluding VAT)

Annual Fee

Key Features

Exclusive Benefits

Earn Miles

Travel Benefits

*Eligible cardholders should call on 04-852-4856 and book the service at least 2 working days prior to their travel/ required drop-off or pick-up date. This desk would be available 6 days a week (Monday to Saturday) between 9am to 7pm.

*Services offered and supported by VISA. Terms and conditions of the offer(s) may change without prior notice. Visit www.visamiddleeast.com for the latest updates.

Lifestyle Benefits

*Services offered and supported by VISA. Terms and conditions of the offer(s) may change without prior notice. Visit www.visamiddleeast.com for the latest updates.

Protection Benefits

*Services offered and supported by VISA. Terms and conditions of the offer(s) may change without prior notice. Visit www.visamiddleeast.com for the latest updates.

Warning

- If you make only the minimum payment for the amount due, it will take longer and cost more to settle your outstanding balance

- If you fail to pay the minimum payment by the due date, you will be committed to pay a donation amount based on the bank’s request (if any) and may impact your credit rating as reported to Al Etihad Credit Bureau

- If you fail to pay the minimum payment by the due date, the Bank will commence the recovery and collection process (which may include engaging third party debt collection agencies) and legal action including bankruptcy

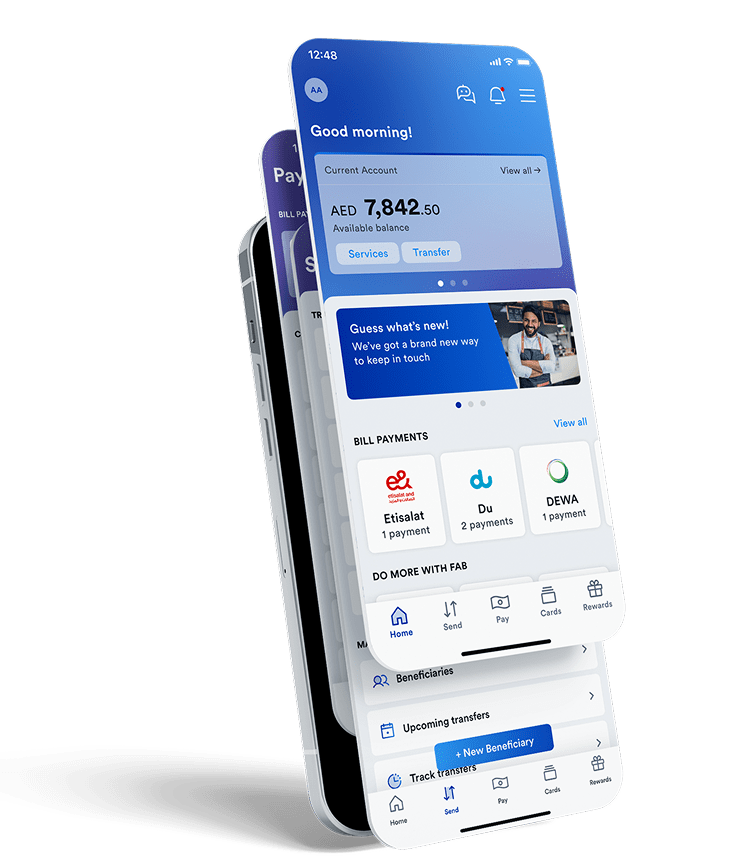

Get your credit card faster on the FAB Mobile app

FAB Mobile puts the power of the bank in your hands

- Get your FAB Islamic account and Islamic credit cards with just your Emirates ID.

- Use your FAB Islamic Rewards to pay your bills anytime, anywhere.

- Check your balance, send money and earn rewards in a few taps.

- Scan the code and choose FAB Islamic to apply for your new account or card faster.

Need more help? Get in touch

Contact us anytime for further assistance or check out our FAQ page for more information.

| For customers within the UAE | For customers outside of the UAE | ||

|---|---|---|---|

| 600 52 5500 | +971 2 681 1511 | ||