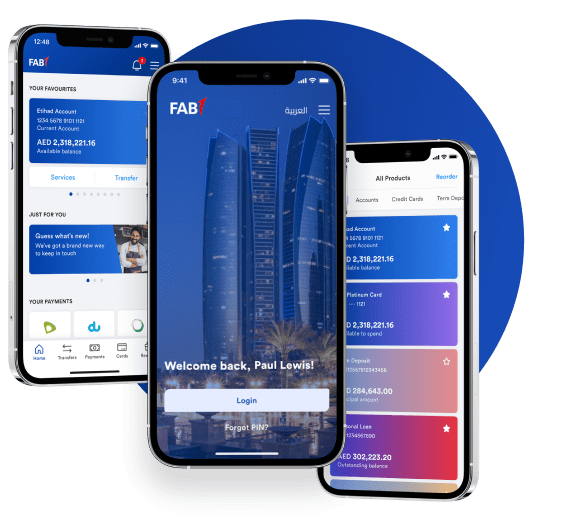

Banking With Us – Bank anytime, anywhere.

Keep up with all your finances on the go.

The FAB Mobile App puts the bank in your hands. Make payments and transfers, manage your accounts, apply for a credit card and so much more.

Digital Wallets - Making every payment easier.

Check out these useful links.

Apple Pay

A modern payment method.

Replace your physical cards and cash with a safe, secure and easy way to pay.

Samsung Pay

Convenient mobile payments.

A better way to pay and simplify all of your transactions.

Payit

Your all in one digital wallet.

Make all your payments securely without worrying about carrying cash.

Click to Pay

The future of payments.

Smart, simple and secure. A faster, password free checkout option with intelligent security that recognises you.

Digital Wallets - Making every payment easier.

Check out these useful links.

Browse through additional services

Learn more about the benefits of our extensive offerings.

Building solid financial foundations

Learn about effective money management solutions and gain a better understanding of your personal finances.

Take a look at our most frequently asked questions, you may find what you’re looking for here

Your e-statement password is made up of the last four digits of your account number. 101XXXXX1234 followed by the day and month of your date of birth 01-02-1989 (DDMM). When you are prompted for password, the 8-digit password to be entered: 12340102.

You can update your mobile number or email address through:

- FAB Mobile - From the Home screen, tap the menu on the top right corner. Tap 'Edit Profile' and select the 'Personal Details' tab to to edit your information such as mobile number, email address and home address

- Online Banking - Select 'Services', go to 'Other Services' and click on 'Update Mobile Number'

You can update your Passport or Visa information through:

- FAB Mobile -From the Home screen, tap the menu on the top right corner. Go to the 'Edit Profile' option and select the 'Documents' tab. Tap 'Add a new document' and choose 'Passport' from the menu to upload your new document. You can do the same for Visa

- Online Banking - Click on your Profile name and select 'My Documents'. From here, select 'Add New Document', choose 'Passport' from the drop down menu and upload the document. You can do the same for the Visa

You can get your IBAN number through:

- FAB website - Use our IBAN Generator tool

- FAB Mobile -Find your IBAN number under your account details on the Home Page

To raise a dispute, download and complete the forms below and email it to us here.

- Credit Card/Debit Card/Payment Card Transaction Dispute Form

- CDM (Cash Deposit Machine) Transaction Dispute Form

- Complete all information on the form including the dispute reason.

- You can dispute the transaction within 60 days from the transaction date.

- All forms must be opened with Adobe Reader.

Need more help? Get in touch

Contact us anytime for further assistance or check out our FAQ page for more information.

| For customers within the UAE | For customers outside of the UAE | ||

|---|---|---|---|

| 600 52 5500 | +971 2 681 1511 | ||