Warning

- Failure to pay your instalments on time could affect your credit rating, which could limit your ability to obtain future financing.

- Please ensure that the instalment amount is available in the account, so that the system can make the due payments on time, to avoid late payments.

- If your payments are delayed, you may be ineligible for some of the services available from the Bank or Housing Authority.

- Late payment of instalments may result in action being taken that may affect the continuity of the financing or any benefits associated therewith.

We have partnered with Abu Dhabi Housing Authority (ADHA) to support in the development of housing programmes and initiatives to meet the needs of the citizens of the Emirate of Abu Dhabi.

Our programme provides Emirati citizens of Abu Dhabi with an interest-free housing loan to buy or to build a private home on a plot of land granted by the Abu Dhabi Housing Authority (ADHA).

Loans are valued up to 2.25 million and are repaid in installments over the approved loan tenor.

Once the customer obtains approval from ADHA, the journey with FAB NHL is as follows.

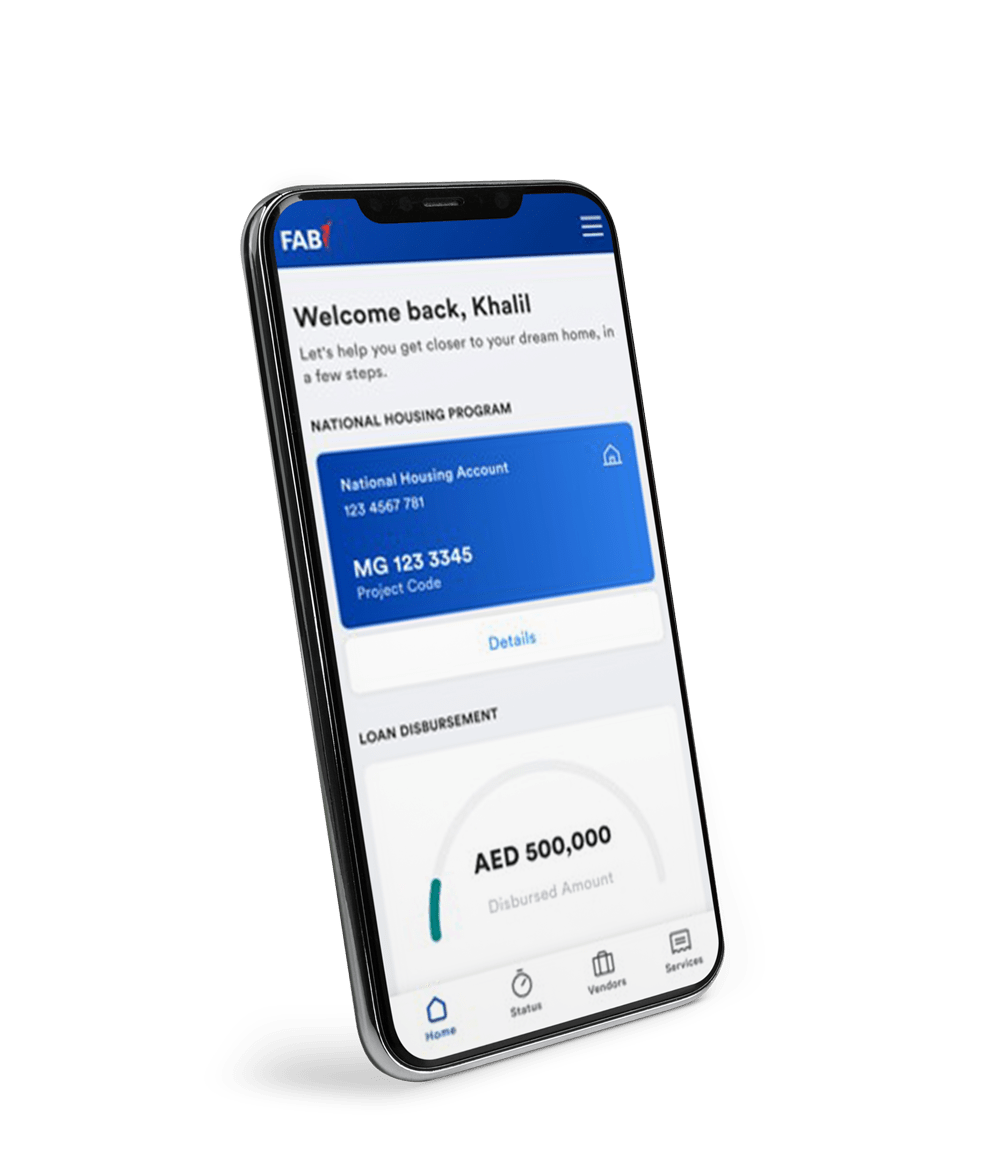

Register to the FAB NHL app

Download and register to the FAB NHL app.

Open and activate your NHL account

Open and activate your NHL account using the FAB NHL app.

- Open your NHL account: Learn more

- Activate your NHL Account: Learn more

Selection of Consultants and Contractors

The customer selects a consultant to draw up the design, then the contractor is selected through a tender.

Construction

The contractor begins construction on the site, and then FAB begins disbursing payments to it, according to the percentage of completion approved by the project consultant.

Delivery

After the works are completed, the contractor will hand over the house to the owner.

Repayment

The installments will be repaid after the delivery of the project, or after two years from the date of granting a loan to the contractor.

Introducing the fully digital joint account journey

We are excited to announce the launch of the fully digital joint account journey on the FAB NHL App - the first of its kind in the UAE.

Customers can now easily open and manage joint accounts with a seamless digital onboarding experience, secure authentication, and end-to-end services, powered by UAE PASS.

Seamless mortgage services through FAB and ADREC integration

A 100% digital journey for UAE Nationals under the National Housing Loans (NHL) programme.

What's New?

Please note: The mortgage application must be submitted and activated through the DARI platform before First Abu Dhabi Bank can process it.

Apply now.

How to benefit from the Abu Dhabi Housing Authority’s New Reduced Deduction Policy!

In line with the “Year of Community” and directives from our wise leadership, the Abu Dhabi Housing Authority has introduced a new policy to reduce monthly deductions for eligible housing programme beneficiaries.

As part of its commitment to supporting the leadership’s vision and promoting the use of smart platforms, First Abu Dhabi Bank will contact eligible beneficiaries via SMS and email with details on how to apply for the reduced deduction:

| Category 1 | Category 2 | Category 3 |

|---|---|---|

| Simply reply to the SMS from the bank to confirm your interest. Watch category 1 video or read the transcript. |

A new direct debit form will be sent to you electronically. This form must be signed and stamped by the bank currently handling your deduction, then sent back to First Abu Dhabi Bank to complete the process. | A representative will get in touch to schedule an appointment to submit the necessary documents. |

Please monitor your SMS and email notifications so you do not miss the opportunity to benefit from the new policy.

The reduced monthly installment will be reflected gradually starting from September 2025.

Customers who join after the announcement of the new policy will automatically receive the reduced monthly installment from the beginning.

Required documents for Single Accounts

Additional Documents Required for Joint Accounts

Notes about required documents

- Please print the following papers (Salary Certificate, Land Plan, Search Certificate, IBAN) before visiting the branch.

- We will not be able to serve you if any of the documents above are missing.

- The name of the owner on the ID and passport must be identical to the name sent by the Abu Dhabi Housing Authority.

- You must provide proof that there is no income or salary if the loan beneficiary is unemployed.

- If the loan beneficiary’s income is from a commercial company, provide a bank statement for the past six months for each licence.

- If the loan beneficiary’s income is rental income, provide rental contracts authenticated by the Municipality and the title deed for the rental properties.

- In the event of a trustee or minor below 21 years of age, provide court authorisation to open the account and conclude and sign the contracts and mortgage.

List of registered FAB contractors and consultants

Put your future in your hands with the FAB NHL app!

- Open and active your NHL account

- Manage your loan and track your installments

- Avail a range of service requests

- Apply for FAB products

- Help and Support

For more information, visit the FAB NHL app page.

FAB Islamic

Need more help? Get in touch.

Contact us anytime for further assistance or check out our FAQ page for more information.

| For customer within the UAE | NHL Service from within in the UAE | ||

|---|---|---|---|

| 600 52 5500 | 600 56 0137 | ||

| For customers from outside of the UAE | NHL Service from outside of the UAE | ||

|---|---|---|---|

| +971 2 681 1511 | +971 2 499 6111 | ||