FAB’s Featured Offers

Get up to 2,000 back and a chance to win a Toyota Land Cruiser with a new Blue FAB Credit Card

Drive away in your new BMW from Abu Dhabi Motors at a 1.49% flat interest rate

Buy a new BMW from Abu Dhabi Motors with a FAB Car Loan and enjoy 1.49% flat interest rate per year.

Drive away in your new MINI from Abu Dhabi Motors at a 1.49% flat interest rate with a FAB Car Loan

Buy a new MINI from Abu Dhabi Motors with a FAB Car Loan and enjoy 1.49% flat interest rate per year.

Don’t miss out on the latest products

Our credit card partners give you more

A credit card with FAB unlocks a variety of rewards, cashback and benefits. Explore our partner offers and get more back today!

Al-Futtaim

The Blue FAB Credit Cards by Al-Futtaim give you great cashback and savings.

Etihad Guest

Our Etihad Guest Cards feature exceptional Etihad Airways and Etihad Guest travel benefits.

GEMS

The GEMS World Credit Card helps you save big on school and family expenses.

Majid Al-Futtaim

FAB SHARE Credit Cards earn you value back in SHARE points for all your shopping, dining and fun.

du

The du Credit Card saves you money on your du bills.

Manchester City

Get the Manchester City Titanium Credit Card and enjoy exclusive Manchester City experiences.

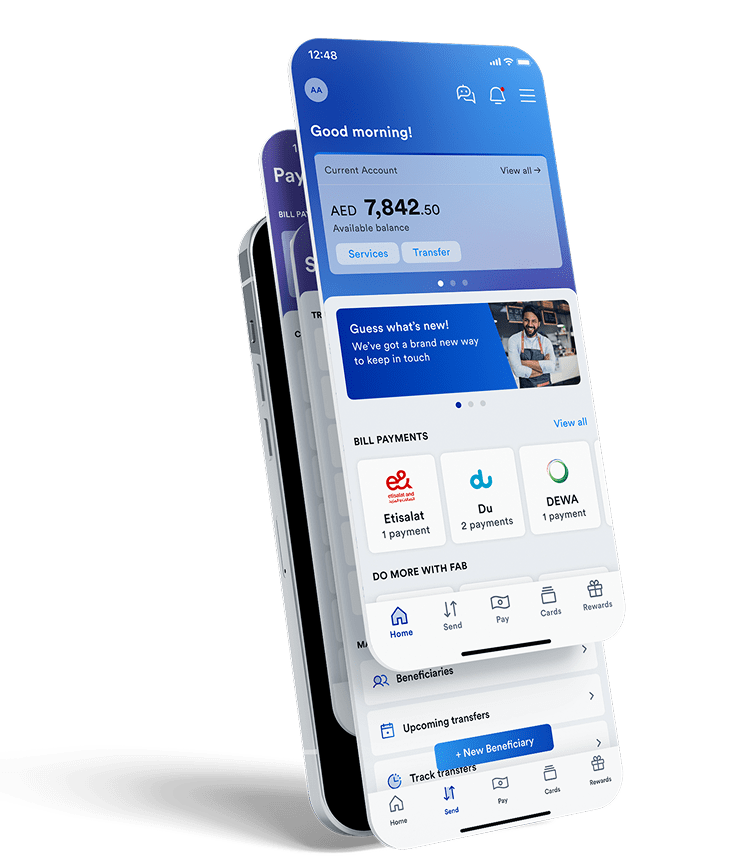

FAB Mobile puts the power of the bank in your hands

Spend, save and stay on top of your everyday transactions, from just about anywhere.

Open a FAB Foreign Currency Account in USD, GBP or EUR and bank anytime and anywhere.

Set up or change the auto-debit for credit arid payments and select options from 5% to 100%.

Check your balances, make payments on time and stay on track.

Get what you need with a few taps.

Tools and Calculators

Stay secure and manage finances efficiently with FAB

Need more help? Get in touch

Contact us anytime for further assistance or check out our FAQ page for more information.

| For customers within the UAE | For customers outside of the UAE | ||

|---|---|---|---|

| 600 52 5500 | +971 2 681 1511 | ||